eBay 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.was a net translation gain of approximately $788.2 million. This gain is recognized as an adjustment to

stockholders’ equity through accumulated other comprehensive income. Additionally, foreign exchange rate

fluctuations may adversely impact our operating results as the revenues and expenses of our foreign operations

are translated into U.S. dollars in preparing our consolidated statement of income. The effect of foreign exchange

rate fluctuations positively impacted our consolidated net revenues and operating income for the year ended

December 31, 2008 by approximately $190.9 million and $130.6 million, respectively, compared to the prior year.

Impact of foreign currency translation only includes changes between our functional currencies and our U.S. dollar

reporting currency.

We consolidate the earnings of our international subsidiaries by converting them into U.S. dollars in

accordance with FAS No. 52 “Foreign Currency Translation” (FAS 52). Such earnings will fluctuate when there

is a change in foreign currency exchange rates. We enter into transactions to hedge portions of our foreign currency

denominated earnings translation exposure using either exchange contracts or other instruments. All contracts that

hedge translation exposure mature ratably over the quarter in which they are executed. During the year ended

December 31, 2008, the realized gains related to these hedges was approximately $26.3 million.

A hypothetical uniform 10% strengthening or weakening in the value of the U.S. dollar relative to the Euro,

British pound, Australian dollar, and Korean won in which our revenues and profits are denominated would result in

a decrease/increase to operating income of approximately $153.8 million. There are inherent limitations in the

sensitivity analysis presented, due primarily to the assumption that foreign exchange rate movements are linear and

instantaneous. As a result, the analysis is unable to reflect the potential effects of more complex market changes that

could arise, which may positively or negatively affect income.

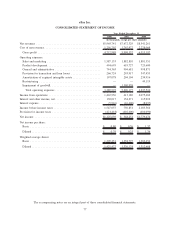

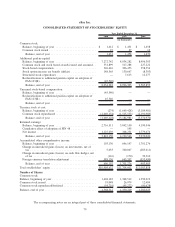

ITEM 8: FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The consolidated financial statements and accompanying notes listed in Part IV, Item 15(a)(1) of this Annual

Report on Form 10-K are included elsewhere in this Annual Report on Form 10-K.

ITEM 9: CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

None.

ITEM 9A: CONTROLS AND PROCEDURES

Evaluation of disclosure controls and procedures. Based on the evaluation of our disclosure controls and

procedures (as defined in the Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, or the

Exchange Act) required by Exchange Act Rules 13a-15(b) or 15d-15(b), our principal executive officer and our

principal financial officer have concluded that as of the end of the period covered by this report, our disclosure

controls and procedures were effective.

Changes in internal controls. There were no changes in our internal controls over financial reporting as

defined in Exchange Act Rule 13a-15(f) that occurred during our most recently completed fiscal quarter that have

materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Management’s Annual Report on Internal Control Over Financial Reporting. Our management is respon-

sible for establishing and maintaining adequate internal control over financial reporting. Our management,

including our principal executive officer and principal financial officer, conducted an evaluation of the effectiveness

of our internal control over financial reporting based on the framework in Internal Control — Integrated Frame-

work issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on its evaluation

under the framework in Internal Control — Integrated Framework, our management concluded that our internal

control over financial reporting was effective as of December 31, 2008.

The effectiveness of our internal control over financial reporting as of December 31, 2008 has been audited by

PricewaterhouseCoopers LLP, an independent registered public accounting firm, as stated in their report which

appears in Item 15(a) of this Annual Report on Form 10-K.

69