eBay 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

approximately $22.1 million due to increased revenues and an increase in our bad debt reserve rate due to the global

economic environment.

Provision for transaction and loan losses increased $27.2 million, or 10%, in 2007 compared to 2006 due

primarily to an increase in transaction loss expense, losses from our consumer protection programs and bad debt

expense. PayPal’s transaction loss rate, which is the transaction loss expense as a percentage of PayPal’s net TPV,

decreased to 0.29% during 2007 compared to 0.35% during 2006 as we continued to refine our fraud prevention

tools; however, transaction loss expense still increased by approximately $12.8 million because of the increase in

net TPV. Losses from our customer protection programs and bad debt expense increased $14.4 million due to

increased revenues and a lower bad debt reserve rate.

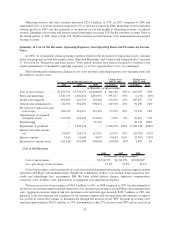

Amortization of Acquired Intangible Assets

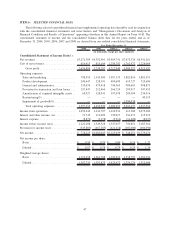

2006 2007 2008

(in thousands, except percentages)

Amortization of acquired intangible assets ................ $197,078 $204,104 $234,916

As a percentage of net revenues ........................ 3.3% 2.7% 2.8%

From time to time we have purchased, and we expect to continue to purchase, assets or businesses to accelerate

category and geographic expansion, increase the features, functions, and formats available to our users and maintain

a leading role in ecommerce, online payments and online communications. These purchase transactions generally

result in the creation of acquired intangible assets with finite lives and lead to a corresponding increase in the

amortization expense in future periods. We amortize intangible assets over the period of estimated benefit, using the

straight-line method and estimated useful lives ranging from one to eight years. The increase in amortization of

acquired amortizable intangibles during 2008 and 2007 compared to prior years is due to the business acquisitions

consummated during 2008, 2007 and 2006. See “Note 3 — Business Combinations, Goodwill and Intangible

Assets” to the consolidated financial statements included in this report.

Restructuring

In October 2008, we implemented a strategic reduction of our existing global workforce by approximately

800 employees worldwide to simplify and streamline our organization and strengthen the overall competitiveness of

our existing businesses. The majority of the costs will impact our Marketplaces business in the U.S. As a result of

this initiative, we estimate that we will incur aggregate costs of approximately $65.0-70.0 million. During the year

ended December 31, 2008, total restructuring charges amounted to $49.1 million, less than our original 2008

estimate of $60.0 million to 70.0 million, as disclosed on our Current Report on Form 8-K filed with the SEC on

October 6, 2008. The restructuring activities are expected to be substantially complete by the end of the first quarter

of 2009. Once completed, the restructuring activities are expected to result in an annual cost savings of approx-

imately $150.0 million. See “Note 9 — Restructuring” to the consolidated financial statements included in this

report.

Impairment of Goodwill

During 2006, 2007 and 2008, we conducted our annual impairment test of goodwill as of August 31 in

accordance with SFAS No. 142, “Goodwill and Other Intangible Assets.” As a result of this test, no goodwill

impairment charges were recorded during 2008 and 2006. However, in 2007, we recorded a $1.4 billion impairment

of goodwill charge related to our Communications segment. Our estimates of future operating results for our

Communications reporting unit are for an early stage business with limited financial history, as well as developing

revenue models. These factors increase the risk of differences between projected and actual performance that could

impact future estimates of fair value of the Communications reporting unit. See “Note 3 — Business Combinations,

Goodwill and Intangible Assets” to the consolidated financial statements included in this report.

57