eBay 2008 Annual Report Download - page 90

Download and view the complete annual report

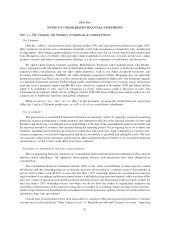

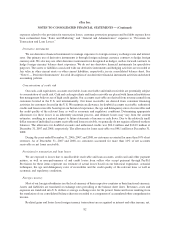

Please find page 90 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.expenses related to the provision for transaction losses, customer protection programs and bad debt expense have

been reclassified from “Sales and Marketing” and “General and Administrative” expenses to “Provision for

Transaction and Loan Losses.”

Derivative instruments

We use derivative financial instruments to manage exposures to foreign currency exchange rates and interest

rates. Our primary use of derivative instruments is through foreign exchange currency contracts to hedge foreign

currency risk. We also may use other derivative instruments not designated as hedges, such as forward contracts to

hedge foreign currency balance sheet exposures. We do not use derivative financial instruments for speculative

purposes. The assets or liabilities associated with our derivative instruments and hedging activities are recorded at

fair value in other current assets or other current liabilities, respectively, in our consolidated balance sheet. See

“Note 6 — Derivative Instruments” for a full description of our derivative financial instrument activities and related

accounting policies.

Concentrations of credit risk

Our cash, cash equivalents, accounts receivable, loans receivable and funds receivable are potentially subject

to concentration of credit risk. Cash and cash equivalents and funds receivable are placed with financial institutions

that management believes are of high credit quality. Our accounts receivable are derived from revenue earned from

customers located in the U.S. and internationally. Our loans receivable are derived from consumer financing

activities for customers located in the U.S. We maintain an allowance for doubtful accounts receivable, authorized

credits and loans receivable based upon our historical experience, the age and delinquency rates of receivables and

the credit quality of the relevant loan, as well as economic and regulatory conditions. Determining appropriate

allowances for these losses is an inherently uncertain process, and ultimate losses may vary from the current

estimates, resulting in a material impact to future statements of income or cash flows. Due to the relatively small

dollar amount of individual accounts receivable and loans receivable, we generally do not require collateral on these

balances. The allowance for doubtful accounts and authorized credits was $96.2 million and $104.9 million at

December 31, 2007 and 2008, respectively. The allowance for loans receivable was $48.1 million at December 31,

2008.

During the years ended December 31, 2006, 2007, and 2008, no customers accounted for more than 10% of net

revenues. As of December 31, 2007 and 2008, no customers accounted for more than 10% of net accounts

receivable or net loans receivable.

Provision for transaction and loan losses

We are exposed to losses due to uncollectible receivable and loan accounts, credit card and other payment

misuse, as well as non-performance of and credit losses from sellers who accept payment through PayPal.

Provisions for these items represent our estimate of actual losses based on our historical experience, actuarial

techniques, the age and delinquency rates of receivables and the credit quality of the relevant loan, as well as

economic and regulatory conditions.

Foreign currency

Most of our foreign subsidiaries use the local currency of their respective countries as their functional currency.

Assets and liabilities are translated at exchange rates prevailing at the balance sheet dates. Revenues, costs and

expenses are translated into U.S. dollars at average exchange rates for the period. Gains and losses resulting from

the translation of our consolidated balance sheet are recorded as a component of accumulated other comprehensive

income.

Realized gains and losses from foreign currency transactions are recognized as interest and other income, net.

82

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)