eBay 2008 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

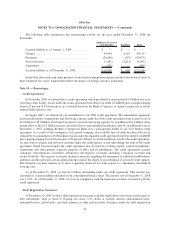

In Europe, we have a cash pooling arrangement with a financial institution for cash management purposes.

This arrangement allows for cash withdrawals from this financial institution based upon our aggregate operating

cash balances held in Europe within the same financial institution (“Aggregate Cash Deposits”). This arrangement

also allows us to withdraw amounts exceeding the Aggregate Cash Deposits up to an agreed-upon limit. The net

balance of the withdrawals and the Aggregate Cash Deposits are used by the financial institution as a basis for

calculating our net interest expense or income. As of December 31, 2008, we had a total of $1.8 billion in cash

withdrawals offsetting our $1.8 billion in Aggregate Cash Deposits held within the same financial institution under

this cash pooling arrangement.

Our financial instruments, including accounts receivable, loans and interest receivable, funds receivable,

accounts payable, funds payable, amounts due to customers and borrowings under our line of credit are carried at

cost, which approximates their fair value because of the short-term maturity of these instruments.

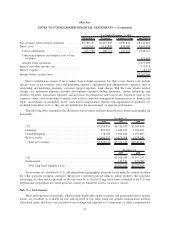

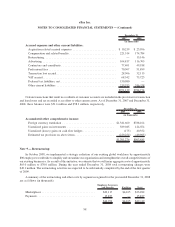

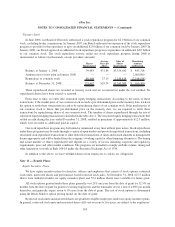

Note 8 — Balance Sheet Components:

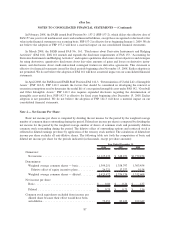

2007 2008

December 31,

(in thousands)

Other current assets:

Prepaid expenses ........................................... $ 70,189 $ 99,735

Deferred tax assets, net ...................................... — 130,908

Prepaid income taxes ........................................ 70,364 60,135

Derivatives ............................................... 5,876 71,149

Other ................................................... 84,486 98,771

$230,915 $460,698

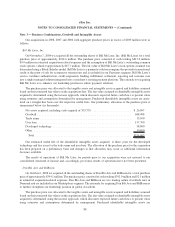

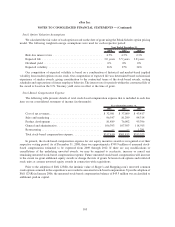

2007 2008

December 31,

(in thousands)

Property and equipment, net:

Computer equipment and software .......................... $1,576,830 $ 1,876,370

Land and buildings, including building improvements ............ 359,982 430,495

Leasehold improvements ................................. 216,710 278,399

Furniture and fixtures.................................... 89,258 100,717

Aviation equipment and other.............................. 189,126 126,028

2,431,906 2,812,009

Accumulated depreciation ................................ (1,311,454) (1,613,295)

$ 1,120,452 $ 1,198,714

Total depreciation expense on our property and equipment was $324.6 million in 2006, $372.5 million in 2007

and $438.2 million in 2008.

97

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)