eBay 2008 Annual Report Download - page 57

Download and view the complete annual report

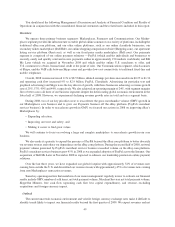

Please find page 57 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.You should read the following Management’s Discussion and Analysis of Financial Condition and Results of

Operations in conjunction with the consolidated financial statements and the related notes included in this report.

Overview

We operate three primary business segments: Marketplaces, Payments and Communications. Our Market-

places segment provides the infrastructure to enable global online commerce on a variety of platforms, including the

traditional eBay.com platform, and our other online platforms, such as our online classifieds businesses, our

secondary tickets marketplace (StubHub), our online shopping comparison website (Shopping.com), our apartment

listing service platform (Rent.com), as well as our fixed price media marketplace (Half.com). Our payments

segment is comprised of our online payment solutions — PayPal (which enables individuals and businesses to

securely, easily and quickly send and receive payments online in approximately 190 markets worldwide) and Bill

Me Later (which we acquired in November 2008 and which enables online U.S. merchants to offer, and

U.S. consumers to obtain, transactional credit at the point of sale). Our Communications segment, which consists

of Skype, enables VoIP calls between Skype users and provides low-cost connectivity to traditional fixed-line and

mobile telephones.

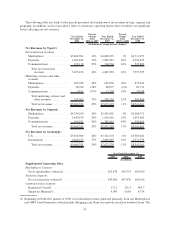

Overall, 2008 revenue increased 11% to $8.5 billion, diluted earnings per share increased from $0.25 to $1.36

and operating cash flow increased 9% to $2.9 billion. PayPal, Classifieds, Advertising (in particular text and

graphical advertising) and Skype were the key drivers of growth, with these businesses achieving a revenue growth

rate of 25%, 57%, 40% and 44%, respectively. We also achieved an operating margin of 24%, with segment margins

flat or better across all three of our business segments despite the deteriorating global economic environment in the

latter half of 2008. However, we experienced declining revenue growth rates in total and on a segment basis.

During 2008, two of our key priorities were to reaccelerate the gross merchandise volume (GMV) growth in

our Marketplaces core business and to grow our Payments business off the eBay platform (PayPal’s merchant

services business). In order to reaccelerate growth in GMV, we focused our actions in 2008 on improving eBay’s

Marketplaces by:

• Expanding selection;

• Improving our trust and safety; and

• Making it easier to find great values.

We will continue to focus on evolving a large and complex marketplace to reaccelerate growth in our core

business.

We also made it a priority to expand the presence of PayPal beyond the eBay.com platform to better diversify

our revenue sources and reduce our dependence on the eBay.com platform. During the second half of 2008, net total

payment volume generated by PayPal’s merchant services business exceeded volume on the eBay.com platform.

PayPal’s merchant services business grew 45% in 2008 as we expanded adoption of PayPal across the Internet. Our

acquisition of Bill Me Later in November 2008 is expected to enhance our leadership position in online payment

solutions.

Over the last three years, we have expanded our global footprint with approximately 54% of revenues now

coming from outside the U.S. and diversified our revenue stream with approximately 45% of revenues now coming

from non-Marketplaces transaction revenues.

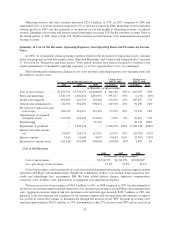

Some key operating metrics that members of our senior management regularly review to evaluate our financial

results include GMV, number of sold items, net total payment volume, Merchant Services net total payment volume,

SkypeOut Minutes, free cash flow (operating cash flow less capital expenditures), and revenue, excluding

acquisitions and foreign currency impact.

Outlook

The current uncertain economic environment and volatile foreign currency exchange rates make it difficult to

identify trends likely to impact our financial results beyond the first quarter of 2009. We expect revenues and net

49