eBay 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our U.S. businesses generate sufficient cash flow to fully fund their operating requirements, and we expect that

profits earned outside the U.S. will be fully utilized to fund our continued international expansion. Accordingly, we

have not provided for U.S. federal income and foreign withholding taxes on non-U.S. subsidiaries’ undistributed

earnings as of December 31, 2008, because such earnings are intended to be reinvested indefinitely. In the event that

our future international expansion plans change and such amounts are not reinvested indefinitely, we would be

subject to U.S. income taxes partially offset by foreign tax credits.

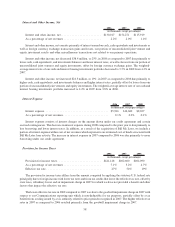

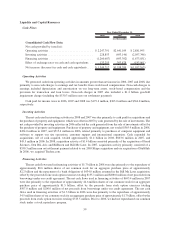

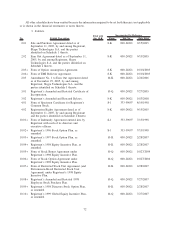

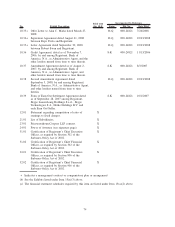

The following table illustrates our effective tax rates for 2006, 2007 and 2008 (in thousands, except

percentages):

2006 2007 2008

Year Ended December 31,

Provision for income taxes ............................ $421,418 $402,600 $404,090

As a % of income before income taxes ................... 27% 54% 19%

We believe historically, these provisions have adequately provided for our actual income tax liabilities. Our

future effective tax rates could be adversely affected by earnings being lower than anticipated in countries where we

have lower statutory rates and higher than anticipated in countries where we have higher statutory rates, by changes

in the valuations of our deferred tax assets or liabilities, or by changes or interpretations in tax laws, regulations or

accounting principles. In addition, we are subject to the continuous examination of our income tax returns by the

Internal Revenue Service, various state tax authorities and other various foreign tax authorities. We regularly assess

the likelihood of adverse outcomes resulting from these examinations to determine the adequacy of our provision

for income taxes.

Based on our results for the year ended December 31, 2008, a one-percentage point change in our provision for

income taxes as a percentage of income before taxes would have resulted in an increase or decrease in the provision

of approximately $21.8 million, resulting in an approximate $0.02 change in diluted earnings per share.

We adopted the provisions of FIN 48 as of the beginning of 2007. Prior to adoption, our policy was to establish

reserves that reflected the probable outcome of known tax contingencies. The effects of final resolution, if any, were

recognized as changes to the effective income tax rate in the period of resolution. FIN 48 requires application of a

more likely than not threshold to the recognition and derecognition of uncertain tax positions. If the recognition

threshold is met, FIN 48 permits us to recognize a tax benefit measured at the largest amount of the tax benefit that,

in our judgment, is more than 50 percent likely to be realized upon settlement. It further requires that a change in

judgment related to the expected ultimate resolution of uncertain tax positions be recognized in earnings in the

quarter of such change.

We file annual income tax returns in multiple taxing jurisdictions around the world. A number of years may

elapse before an uncertain tax position is audited and finally resolved. While it is often difficult to predict the final

outcome or the timing of resolution of any particular uncertain tax position, we believe that our reserves for income

taxes reflect the most likely outcome. We adjust these reserves, as well as the related interest, in light of changing

facts and circumstances. Settlement of any particular position could require the use of cash.

Revenue Recognition

We recognize revenue from services rendered when the following four revenue recognition criteria are met:

persuasive evidence of an arrangement exists, services have been rendered, the selling price is fixed or deter-

minable, and collectability is reasonably assured. We may enter into certain revenue transactions that involve

multiple element arrangements (arrangements with more than one deliverable). We also may enter into arrange-

ments to purchase goods and/or services from certain customers. As a result, significant contract interpretation is

sometimes required to determine appropriate accounting for these transactions including: (1) whether an arrange-

ment exists; (2) how the arrangement consideration should be allocated among potential multiple arrangements;

(3) when to recognize revenue on the deliverables; (4) whether all elements of the arrangement have been delivered;

(5) whether the arrangement should be reported gross (as a principal) versus net (as an agent); (6) whether we

receive a separately identifiable benefit from the purchase arrangements with our customer for which we can

reasonably estimate fair value; and (7) whether the arrangement would be characterized as revenue or

64