eBay 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

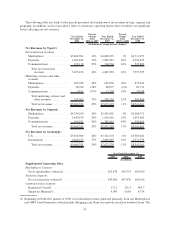

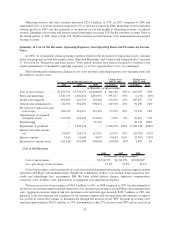

2004 2005 2006 2007 2008

December 31,

(in thousands)

Consolidated Balance Sheet Data:

Cash and cash equivalents .......... $1,330,045 $ 1,313,580 $ 2,662,792 $ 4,221,191 $ 3,188,928

Short-term investments ............ 837,409 804,352 554,841 676,264 163,734

Long-term investments ............ 1,266,289 825,667 277,853 138,237 106,178

Working capital(5) . . ............. 1,826,279 1,698,302 2,452,191 4,022,926 2,581,503

Total assets ..................... 7,991,051 11,788,986 13,494,011 15,366,037 15,592,439

Short-term obligations ............. 124,272 — — — —

Borrowings under credit agreement

(short-term)................... — — — 200,000 1,000,000

Total stockholders’ equity .......... 6,728,341 10,047,981 10,904,632 11,704,602 11,083,858

(1) These results include acquired company results of operations beginning on the date of acquisition. For a

summary of recent significant acquisitions, see “Note 3 — Business Combination, Goodwill and Intangible

Assets” to the consolidated financial statements included in this report. Certain prior year amounts have been

reclassified to conform to the current year’s presentation. For further details regarding reclassified amounts see

“Note 1 — The Company and Summary of Significant Accounting Policies” to the consolidated financial

statements included in this report.

(2) Consolidated Statement of Income for the years ended December 31, 2006, 2007 and 2008 includes stock-based

compensation expense under Statement of Financial Accounting Standards (“SFAS”) No. 123 (revised 2004),

“Share-Based Payment” (“FAS 123(R)”) of $317.4 million, $301.8 million and $353.2, respectively. Because

we implemented FAS 123(R) as of January 1, 2006, prior periods do not reflect stock-based compensation

expense related to this new accounting standard. See “Note 15 — Benefit Plans” to the consolidated financial

statements included in this report.

(3) Consolidated Statement of Income for the year ended December 31, 2008 includes restructuring charges of

$49.1 million. See “Note 9 — Restructuring” to the consolidated financial statements included in this report.

(4) Consolidated Statement of Income for the year ended December 31, 2007 includes a goodwill impairment

charge of $1.4 billion. See “Note 3 — Business Combination, Goodwill and Intangible Assets” to the

consolidated financial statements included in this report.

(5) Working capital is calculated as the difference between total current assets and total current liabilities.

ITEM 7: MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements that involve

expectations, plans or intentions (such as those relating to future business or financial results, new features or

services, or management strategies). You can identify these forward-looking statements by words such as “may,”

“will,” “would,” “should,” “could,” “expect,” “anticipate,” “believe,” “estimate,” “intend,” “plan” and other

similar expressions. These forward-looking statements involve risks and uncertainties that could cause our actual

results to differ materially from those expressed or implied in our forward-looking statements. Such risks and

uncertainties include, among others, those discussed in “Item 1A: Risk Factors,” of this Annual Report on

Form 10-K as well as our consolidated financial statements, related notes, and the other financial information

appearing elsewhere in this report and our other filings with the SEC. We do not intend, and undertake no

obligation, to update any of our forward-looking statements after the date of this report to reflect actual results or

future events or circumstances. Given these risks and uncertainties, readers are cautioned not to place undue

reliance on such forward-looking statements.

48