eBay 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Loans receivable, net

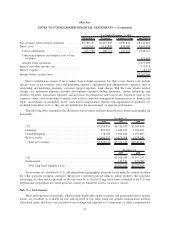

Loans receivable represent extensions of credit to individual consumers to purchase goods and services

through our Bill Me Later merchant network. The terms of the consumer relationship require us to submit monthly

bills to the consumer detailing loan repayment requirements. The terms also allow us to charge the consumer, in

certain circumstances, interest and fees. Loans receivable are reported at their outstanding principal balances, net of

deferred origination costs and net of allowance, and include the estimated collectible interest and fees. We charge

off loans receivable in the month in which the customer becomes 180 days past due. Bankrupt accounts are charged

off within 60 days of receiving notification from the bankruptcy courts.

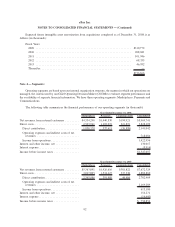

Funds receivable and funds payable

Funds receivable and payable relate to our Payments segment and arise due to the time taken to clear

transactions through external payment networks. When customers fund their account using their bank account or

credit card, or withdraw money to their bank account or through a debit card transaction, there is a clearing period

before the cash is received or settled, usually one to three business days for U.S. transactions, and up to five business

days for international transactions. Hence, these funds are treated as a receivable or payable, as the case may be,

until the cash is settled.

Customer accounts

Based on differences in regulatory requirements and commercial law in the jurisdictions where PayPal

operates, PayPal holds customer balances either as direct claims against PayPal or as an agent or custodian on behalf

of PayPal’s customers. Customer balances held as direct claims against PayPal are included on our consolidated

balance sheet as funds receivable and customer accounts with an offsetting current liability in funds payable and

amounts due to customers. The customer balances can be invested only in specified types of liquid assets.

Customer funds held by PayPal as an agent or custodian on behalf of our customers are not reflected in our

consolidated balance sheet. These off-balance sheet funds totaled approximately $1.8 billion and $1.9 billion as of

December 31, 2007 and 2008, respectively. These off-balance sheet funds include funds held in the U.S. that are

deposited in bank accounts insured by the Federal Deposit Insurance Corporation and funds that customers choose

to invest in the PayPal Money Market Fund. The PayPal Money Market Fund is invested in a portfolio managed by

Barclays Global Fund Advisors.

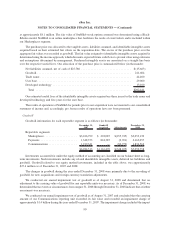

Property and equipment

Property and equipment are stated at historical cost less accumulated depreciation. Depreciation and amor-

tization are computed using the straight-line method over the estimated useful lives of the assets, generally, one to

three years for computer equipment and software, up to 30 years for buildings and building improvements, ten years

for aviation equipment, the shorter of five years or the term of the lease for leasehold improvements, three years for

furniture and fixtures and three years for vehicles.

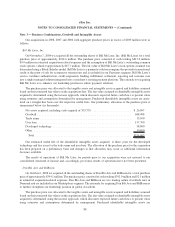

Goodwill and intangible assets

Goodwill represents the excess of the purchase price over the fair value of the net tangible and identifiable

intangible assets acquired in a business combination. Intangible assets resulting from the acquisitions of entities

accounted for using the purchase method of accounting are estimated by management based on the fair value of

assets received. Identifiable intangible assets are comprised of purchased customer lists and user base, trademarks

and trade names, developed technologies, and other intangible assets. Identifiable intangible assets are amortized

over the period of estimated benefit using the straight-line method and estimated useful lives ranging from one to

eight years. Goodwill is not subject to amortization, but is subject to at least an annual assessment for impairment,

applying a fair-value based test.

83

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)