eBay 2008 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2008 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

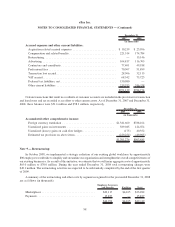

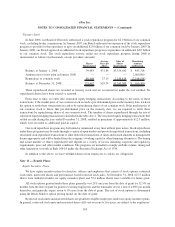

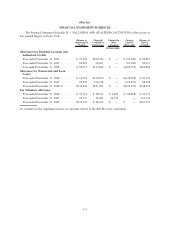

The following is a reconciliation of the difference between the actual provision for income taxes and the

provision computed by applying the federal statutory rate of 35% for 2006, 2007, and 2008 to income before income

taxes (in thousands):

2006 2007 2008

Year Ended December 31,

Provision at statutory rate ........................... $541,471 $ 262,798 $ 764,248

Permanent differences:

Foreign income taxed at different rates ............... (230,350) (404,007) (519,203)

Goodwill impairment ............................ — 486,828 —

Change in valuation allowance ..................... 35,652 34,983 48,614

Stock-based compensation ......................... 26,179 24,516 26,730

State taxes, net of federal benefit .................... 58,542 15,672 54,356

Tax credits .................................... (1,142) (7,766) (9,251)

Other........................................ (8,934) (10,424) 38,596

$ 421,418 $ 402,600 $ 404,090

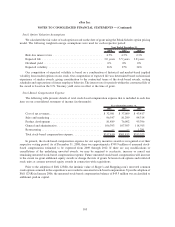

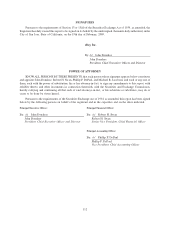

Deferred tax assets and liabilities are recognized for the future tax consequences of differences between the

carrying amounts of assets and liabilities and their respective tax bases using enacted tax rates in effect for the year

in which the differences are expected to reverse. Significant deferred tax assets and liabilities consist of the

following (in thousands):

2007 2008

December 31,

Deferred tax assets:

Net operating loss and credits ................................ $159,333 $ 311,807

Accruals and allowances . ................................... 174,552 242,763

Stock-based compensation ................................... 158,767 212,147

Net unrealized (gains) losses ................................. 4,145 4,052

Net deferred tax assets . . ................................... 496,797 770,769

Valuation allowance ....................................... (119,153) (167,767)

377,644 603,002

Deferred tax liabilities:

Acquisition-related intangibles ................................ (152,068) (165,793)

Depreciation and amortization ................................ (36,462) (73,477)

Available-for-sale securities .................................. (235,894) (48,812)

Foreign statutory reserves ................................... (12,386) (19,498)

(436,810) (307,580)

$ (59,166) $ 295,422

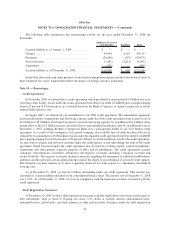

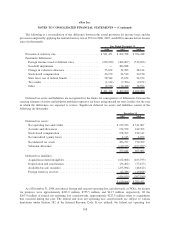

As of December 31, 2008 our federal, foreign and state net operating loss carryforwards, or NOLs, for income

tax purposes were approximately $263.9 million, $755.5 million, and $41.7 million, respectively. Of the

$263.9 million of federal net operating loss carryforwards, approximately $227.5 million relate to acquisitions

that occurred during the year. The federal and state net operating loss carryforwards are subject to various

limitations under Section 382 of the Internal Revenue Code. If not utilized, the federal net operating loss

108

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)