WeightWatchers 2012 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2012 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

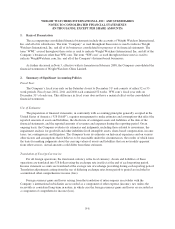

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

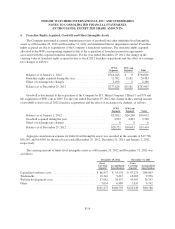

3. Acquisitions of Franchisees and Minority Equity Interest in China Joint Venture

Acquisitions of Franchisees

The acquisitions of franchisees have been accounted for under the purchase method of accounting and,

accordingly, earnings of acquired franchisees have been included in the consolidated operating results of the

Company since the applicable date of acquisition. During the third and fourth quarters of fiscal 2012, the

Company acquired certain assets of its franchisees as outlined below. There were no key franchise acquisitions in

fiscal 2011 and fiscal 2010.

On September 10, 2012, the Company acquired substantially all of the assets of its Southeastern Ontario and

Ottawa, Canada franchisee, Slengora Limited, for a net purchase price of $16,755 plus assumed liabilities of

$245. The total purchase price has been allocated to franchise rights acquired ($9,871), goodwill ($6,779),

customer relationship value ($180), fixed assets ($81), inventory ($66) and prepaid expenses ($23).

On November 2, 2012, the Company acquired substantially all of the assets of its Adirondacks franchisee,

Weight Watchers of the Adirondacks, Inc., for a purchase price of $3,400. The total purchase price has been

preliminarily allocated to franchise rights acquired ($2,216), goodwill ($1,156), customer relationship value

($37), inventory ($29) and prepaid expenses ($10) offset by deferred revenue of $48.

On December 20, 2012, the Company acquired substantially all of the assets of its Memphis, Tennessee

franchisee, Weight Watchers of the Mid-South, Inc., for a purchase price of $10,000. The total purchase price has

been preliminarily allocated to franchise rights acquired ($8,396), goodwill ($1,461), customer relationship value

($209), inventory ($35), receivables ($9) and fixed assets ($4) offset by deferred revenue of $114.

The weighted-average amortization period of the customer relationships acquired in the above acquisitions

was approximately 12 weeks. Due to the short-term nature of this asset, its estimated fair value has been recorded

as a component of prepaid expenses and other current assets. The goodwill recorded in connection with these

acquisitions represents the intangible assets that did not qualify for separate recognition in the financial

statements. The Company expects that $7,701 of the total $9,396 of goodwill recorded in connection with the

above acquisitions will be deductible for tax purposes. The effect of these franchise acquisitions was not material

to the Company’s consolidated financial position, results of operations, or operating cash flows in the periods

presented.

Acquisition of Minority Equity Interest in China Joint Venture

On February 5, 2008, Weight Watchers Asia Holdings Ltd. (“Weight Watchers Asia”), a direct, wholly-

owned subsidiary of the Company, and Danone Dairy Asia (“Danone Asia”), an indirect, wholly-owned

subsidiary of Groupe DANONE S.A., entered into a joint venture agreement to establish a weight management

business in the People’s Republic of China. Pursuant to the terms of the joint venture agreement, Weight

Watchers Asia and Danone Asia owned 51% and 49%, respectively, of the joint venture entity, Weight Watchers

China Limited (together with all of its businesses, the “China Joint Venture”). Because the Company had a direct

controlling financial interest in the China Joint Venture, it consolidated the entity from the first quarter of

fiscal 2008.

On April 27, 2011, Weight Watchers Asia entered into a share purchase agreement with Danone Asia,

pursuant to which Weight Watchers Asia acquired Danone Asia’s 49% minority equity interest in the China Joint

Venture as of that date for consideration of $1. Effective April 27, 2011, the date of the acquisition of Danone

Asia’s minority equity interest by Weight Watchers Asia, the Company owns 100% of the China Joint Venture

and no longer accounts for a non-controlling interest in the China Joint Venture. The noncontrolling interest that

had been reflected on the Company’s balance sheet was reclassified to retained earnings.

F-13