WeightWatchers 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

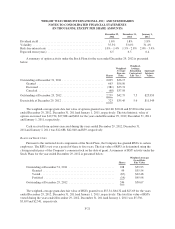

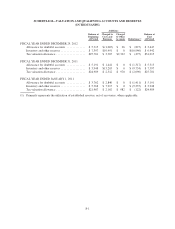

Basic and diluted EPS are computed independently for each of the periods presented. Accordingly, the sum

of the quarterly EPS amounts may not agree to the total for the year.

As discussed in further detail in Note 13, in the fourth quarter of fiscal 2012, the Company recognized a

$4,099 net benefit ($7,423 pre-tax), or $0.07 per fully diluted share, from an accrual reversal associated with the

settlement in the quarter of the previously reported UK self-employment tax litigation. The $7,423 pre-tax net

benefit associated with the settlement consisted of an over-accrual reversal to cost of revenues of $14,544

partially offset by an additional interest accrual of $7,130.

18. Recently Issued Accounting Pronouncements

In July 2012, the Financial Accounting Standards Board (the “FASB”) issued updated guidance on the

periodic testing of indefinite-lived intangible assets for impairment. This guidance allows companies to first

assess qualitative factors to determine if it is more-likely-than-not that an indefinite-lived intangible asset might

be impaired and whether it is necessary to perform the quantitative impairment test required under current

accounting standards. This guidance is applicable for fiscal years beginning after September 15, 2012, with early

adoption permitted. The Company adopted the provisions of this guidance in the third quarter of fiscal 2012. The

adoption of this guidance did not have any affect on the consolidated financial position, results of operations or

cash flows of the Company.

In September 2011, the FASB issued updated guidance on the periodic testing of goodwill for impairment.

This guidance allows companies to assess qualitative factors to determine if it is more-likely-than-not that

goodwill might be impaired and whether it is necessary to perform the two-step goodwill impairment test

required under current accounting standards. This guidance is applicable for fiscal years beginning after

December 15, 2011, with early adoption permitted. The Company adopted the provisions of this guidance in the

first quarter of fiscal 2012. The adoption of this guidance did not have any affect on the consolidated financial

position, results of operations or cash flows of the Company.

In June 2011, the FASB issued authoritative guidance requiring companies to present the total of

comprehensive income, the components of net income and the components of other comprehensive income either

in a single continuous statement of comprehensive income or in two separate but consecutive statements. The

provisions of the guidance are effective for fiscal years, and interim periods within those years, beginning after

December 15, 2011. In December 2011, the FASB issued an amendment deferring the effective date for the

presentation of reclassification adjustments out of accumulated other comprehensive income. The Company

adopted the provisions of this guidance in the first quarter of fiscal 2012, and such adoption did not affect the

consolidated financial position, results of operations or cash flows of the Company.

In May 2011, the FASB issued authoritative fair value guidance entitled “Fair Value Measurement:

Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and

IFRSs”. Some of the amendments included in the guidance clarify the FASB’s intent about the application of

existing fair value measurement requirements. Other amendments change a particular principle or requirement

for measuring fair value or for disclosing information about fair value measurements. This guidance is effective

for interim and annual periods beginning after December 15, 2011. The Company adopted the provisions of this

guidance in the first quarter of fiscal 2012, and such adoption did not have a material impact on the disclosures in

its consolidated financial statements.

F-31