WeightWatchers 2012 Annual Report Download - page 36

Download and view the complete annual report

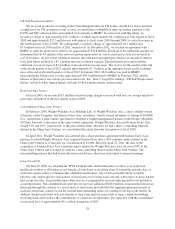

Please find page 36 of the 2012 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 3. Legal Proceedings

UK Self-Employment Matter

In July 2007, Her Majesty’s Revenue and Customs, or HMRC, issued to us notices of determination and

decisions that, for the period April 2001 to April 2007, our leaders and certain other service providers in the

United Kingdom should have been classified as employees for tax purposes and, as such, we should have

withheld tax from the leaders and certain other service providers pursuant to the “Pay As You Earn,” or PAYE,

and national insurance contributions, or NIC, collection rules and remitted such amounts to HMRC. HMRC also

issued a claim to us in October 2008 in respect of NIC which corresponds to the prior notices of assessment with

respect to PAYE previously raised by HMRC.

In September 2007, we appealed to the UK First Tier Tribunal (Tax Chamber) (formerly known as the

UK VAT and Duties Tribunal), or the First Tier Tribunal, HMRC’s notices as to these classifications and against

any amount of PAYE and NIC liability claimed to be owed by us. In February 2010, the First Tier Tribunal

issued a ruling that our UK leaders should have been classified as employees for UK tax purposes and, as such,

we should have withheld tax from our leaders pursuant to the PAYE and NIC collection rules for the period from

April 2001 to April 2007 with respect to services performed by the leaders for us. We appealed the First Tier

Tribunal’s adverse ruling to the UK Upper Tribunal (Tax and Chancery Chamber), or the Upper Tribunal, and in

October 2011, the Upper Tribunal issued a ruling dismissing our appeal. In January 2012, we sought permission

from the UK Court of Appeal to appeal the Upper Tribunal’s ruling, which the UK Court of Appeal refused in

March 2012. In March 2012, we applied to the UK Court of Appeal for an oral hearing to seek permission to

appeal to the UK Court of Appeal against the Upper Tribunal’s ruling. At the hearing in June 2012, the UK Court

of Appeal granted us permission to appeal. A hearing date for the appeal was set for January 2013.

In December 2011, HMRC’s claim in respect of NIC was amended to increase the claimed amount for the

period April 2002 to April 2007 and include the interest accrued thereon through December 2011. In addition, in

February 2012, HMRC asserted a claim in respect of PAYE for the period April 2007 to April 2011 similar to

what it had claimed for the period April 2001 to April 2007. We were granted permission to appeal this PAYE

claim with the First Tier Tribunal and the First Tier Tribunal directed that the appeal be stayed until following

the decision of the UK Court of Appeal with respect to our appeal of the Upper Tribunal’s ruling.

In light of the First Tier Tribunal’s adverse ruling and in accordance with accounting guidance for

contingencies, we recorded in the fourth quarter of fiscal 2009 a reserve for the period from April 2001 through

the end of fiscal 2009, inclusive of estimated accrued interest. On a quarterly basis, beginning in the first quarter

of fiscal 2010 and through the second quarter of fiscal 2011, we recorded a reserve for UK withholding taxes

with respect to our UK leaders consistent with this ruling. The reserve at the end of the second quarter of fiscal

2011 equaled approximately $43.7 million in the aggregate based on the exchange rates at the end of fiscal 2011.

As of the beginning of the third quarter of fiscal 2011, we began employing our UK leaders and therefore have

ceased recording any further reserves for this matter. In February 2012, we paid HMRC, on a without prejudice

basis, a portion of the amount previously reserved equal to approximately $30.0 million based on the exchange

rates at the payment date for estimated amounts claimed to be owed by us with respect to PAYE and interest

thereon for the period April 2001 to July 2011. In December 2012, we reached an agreement with HMRC to

settle the matter in its entirety for approximately $36.8 million. In January 2013, $6.8 million was paid to

HMRC, representing the balance due over the amount previously paid to HMRC in February 2012. In January

2013, the UK Court of Appeal dismissed the case and the First Tier Tribunal confirmed withdrawal of our appeal

against HMRC.

Other Litigation Matters

Due to the nature of our activities, we are also, at times, subject to pending and threatened legal actions that

arise out of the ordinary course of business. In the opinion of management, based in part upon advice of legal

20