WeightWatchers 2012 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2012 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.requirements and to comply with all of the financial covenants under our debt agreements depends on our future

operations, performance and cash flow. These are subject to prevailing economic conditions and to financial,

business and other factors, some of which are beyond our control.

Off-Balance Sheet Transactions

As part of our ongoing business, we do not participate in transactions that generate relationships with

unconsolidated entities or financial partnerships established for the purpose of facilitating off-balance sheet

arrangements or other contractually narrow or limited purposes, such as entities often referred to as structured

finance or special purpose entities.

Related Parties

For a discussion of related party transactions affecting us, see “Item 12. Certain Relationships and Related

Transactions, and Director Independence” in Part III of this Annual Report on Form 10-K.

Seasonality

Our business is seasonal, with revenues generally decreasing at year end and during the summer months.

Our operating income for the first half of the year is generally the strongest. Our advertising schedule generally

supports the three key recruitment-generating seasons of the year: winter, spring and fall, with winter having the

highest concentration of advertising spending. The timing of certain holidays, particularly Easter, which precedes

the spring marketing campaign and occurs between March 22 and April 25, may affect our results of operations

and the year-to-year comparability of our results. The introduction of Monthly Pass in the meetings business has

resulted in less seasonality with regard to our meeting fee revenues because its revenues are amortized over the

related subscription period. While WeightWatchers.com experiences seasonality similar to the meetings business

in terms of new subscriber sign-ups, its revenue tends to be less seasonal because it amortizes subscription

revenue over the related subscription period.

Recently Issued Accounting Pronouncements

In July 2012, the Financial Accounting Standards Board, or the FASB, issued updated guidance on the

periodic testing of indefinite-lived intangible assets for impairment. This guidance allows companies to first

assess qualitative factors to determine if it is more-likely-than-not that an indefinite-lived intangible asset might

be impaired and whether it is necessary to perform the quantitative impairment test required under current

accounting standards. This guidance is applicable for fiscal years beginning after September 15, 2012, with early

adoption permitted. The Company adopted the provisions of this guidance in the third quarter of fiscal 2012. The

adoption of this guidance did not have any affect on the consolidated financial position, results of operations or

cash flows of the Company.

In September 2011, the FASB issued updated guidance on the periodic testing of goodwill for impairment.

This guidance allows companies to assess qualitative factors to determine if it is more-likely-than-not that

goodwill might be impaired and whether it is necessary to perform the two-step goodwill impairment test

required under current accounting standards. This guidance is applicable for fiscal years beginning after

December 15, 2011, with early adoption permitted. The Company adopted the provisions of this guidance in the

first quarter of fiscal 2012. The adoption of this guidance did not have any affect on the consolidated financial

position, results of operations or cash flows of the Company.

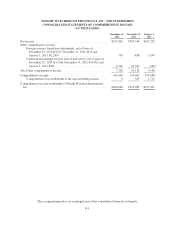

In June 2011, the FASB issued authoritative guidance requiring companies to present the total of

comprehensive income, the components of net income and the components of other comprehensive income either

in a single continuous statement of comprehensive income or in two separate but consecutive statements. The

provisions of the guidance are effective for fiscal years, and interim periods within those years, beginning after

December 15, 2011. In December 2011, the FASB issued an amendment deferring the effective date for the

62