WeightWatchers 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

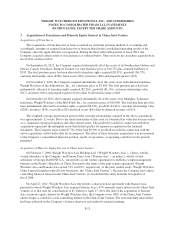

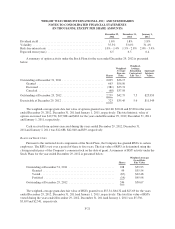

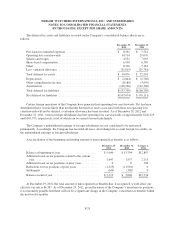

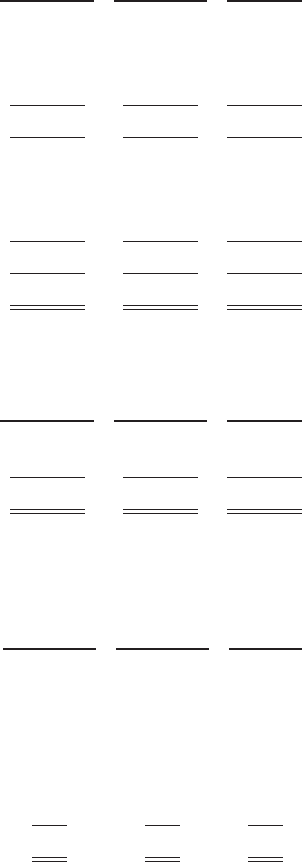

10. Income Taxes

The following tables summarize the Company’s consolidated provision for US federal, state and foreign

taxes on income:

December 29,

2012

December 31,

2011

January 1,

2011

Current:

US federal .............................................. $ 99,437 $121,860 $ 68,126

State ................................................... 12,719 18,298 11,462

Foreign ................................................ 20,614 13,299 18,693

$132,770 $153,457 $ 98,281

Deferred:

US federal .............................................. $ 23,002 $ 23,410 $ 20,115

State ................................................... 2,629 2,675 2,299

Foreign ................................................ 1,134 (794) (39)

$ 26,765 $ 25,291 $ 22,375

Total tax provision ....................................... $159,535 $178,748 $120,656

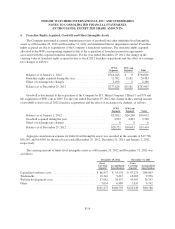

The components of the Company’s consolidated income before income taxes consist of the following:

December 29,

2012

December 31,

2011

January 1,

2011

Domestic ................................................... $337,321 $400,310 $236,864

Foreign .................................................... 79,640 82,782 76,314

$416,961 $483,092 $313,178

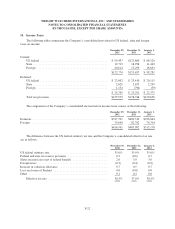

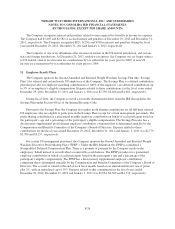

The difference between the US federal statutory tax rate and the Company’s consolidated effective tax rate

are as follows:

December 29,

2012

December 31,

2011

January 1,

2011

US federal statutory rate ....................................... 35.0% 35.0% 35.0%

Federal and state tax reserve provision ............................ 0.2 (0.6) 0.7

States income taxes (net of federal benefit) ........................ 2.6 3.0 3.0

Foreign taxes ................................................ (0.3) (0.4) (0.9)

Increase in valuation allowance ................................. 0.7 0.5 0.7

Loss on closure of Finland ..................................... 0.0 (0.8) 0.0

Other ...................................................... 0.1 0.3 0.0

Effective tax rate ......................................... 38.3% 37.0% 38.5%

F-22