WeightWatchers 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Immediately prior to the amendment of the WWI Credit Facility, the term loan facilities consisted of a

tranche A-1 loan, or Term A-1 Loan, a tranche B loan, or Term B Loan, a tranche C loan, or Term C Loan, and a

tranche D loan, or Term D Loan, and a revolving credit facility, or Revolver A-1. The aggregate principal

amount then outstanding under (i) the Term A-1 Loan was $128.6 million, (ii) the Term B Loan was $237.5

million, (iii) the Term C Loan was $420.4 million and (iv) the Term D Loan was $238.2 million. Immediately

prior to the amendment of the WWI Credit Facility, the Revolver A-1 had no loans outstanding under it, $1.0

million of issued but undrawn letters of credit and $331.6 million in available unused commitments thereunder.

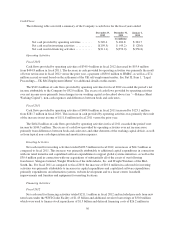

Following the amendment of the WWI Credit Facility on March 15, 2012, (i) $33.1 million in aggregate

principal amount of the Term A-1 Loan and $301.8 million in aggregate principal amount of the Term C Loan

were converted into, and $849.4 million in aggregate principal amount of commitments to borrow new term

loans were provided under, a new tranche E loan, or Term E Loan, (ii) $107.0 million in aggregate principal

amount of the Term B Loan and $119.1 million in aggregate principal amount of the Term D Loan were

converted into, and $600.0 million in aggregate principal amount of commitments to borrow new term loans

were provided under, a new tranche F loan, or Term F Loan, and (iii) $262.0 million in aggregate principal

amount of commitments under the Revolver A-1 were converted into a new revolving credit facility, or Revolver

A-2. The loans outstanding under each term loan facility existing prior to the amendment of the WWI Credit

Facility and the loans and commitments outstanding under the Revolver A-1, in each case that were not

converted into the Term E Loan, the Term F Loan or the Revolver A-2, as applicable, continued to remain

outstanding under the WWI Credit Facility as the Term A-1 Loan, the Term B Loan, the Term C Loan, the

Term D Loan or the Revolver A-1, as applicable. In connection with this amendment, we incurred fees of

approximately $26.2 million in the first quarter of fiscal 2012. On March 27, 2012, we borrowed an aggregate of

$726.0 million under the Term E Loan and the Term F Loan to finance the purchase of shares in the Tender Offer

and to pay a portion of the related fees and expenses. On April 9, 2012, we borrowed an aggregate of

approximately $723.4 million under the Term E Loan to finance the purchase of shares from Artal Holdings. At

December 29, 2012, we had $2,406.4 million outstanding under the WWI Credit Facility, a combination of term

loans and amounts outstanding under the Revolver A-1 and the Revolver A-2. In addition, at December 29, 2012,

the Revolver A-1 had $0.2 million in issued but undrawn letters of credit outstanding thereunder and $64.1

million in available unused commitments thereunder and the Revolver A-2 had $0.9 million in issued but

undrawn letters of credit outstanding thereunder and $237.4 million in available unused commitments

thereunder.

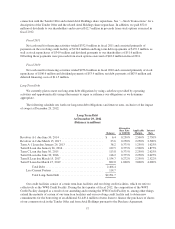

At the end of fiscal 2012, fiscal 2011 and fiscal 2010, our debt consisted entirely of variable-rate

instruments. Interest rate swaps were entered into to hedge a portion of the cash flow exposure associated with

our variable-rate borrowings. The average interest rate on our debt, exclusive of the impact of swaps, was

approximately 3.0%, 2.4% and 2.2% per annum at the end of fiscal 2012, fiscal 2011 and fiscal 2010,

respectively.

The WWI Credit Facility provides that term loans and the loans outstanding under the Revolver A-1 and the

Revolver A-2 bear interest at a rate per annum equal to either, at our option, the LIBO Rate (Reserve Adjusted)

(as defined in the WWI Credit Facility agreement) plus an applicable margin or the Alternate Base Rate (as

defined in the WWI Credit Facility agreement) plus an applicable margin, which applicable margins will vary

depending on our Net Debt to EBITDA Ratio (as defined in the WWI Credit Facility agreement) from time to

time in effect. At December 29, 2012, the Term A-1 Loan bore interest at a rate equal to LIBO Rate (Reserve

Adjusted) plus 1.25% per annum; the Term B Loan bore interest at a rate equal to LIBO Rate (Reserve Adjusted)

plus 1.50% per annum; the Term C Loan bore interest at a rate equal to LIBO Rate (Reserve Adjusted) plus

2.25% per annum; the Term D Loan bore interest at a rate equal to LIBO Rate (Reserve Adjusted) plus

2.25% per annum; the Term E Loan bore interest at a rate equal to LIBO Rate (Reserve Adjusted) plus 2.25% per

annum; the Term F Loan bore interest at a rate equal to LIBO Rate (Reserve Adjusted) plus 3.00% per annum;

the Revolver A-1 bore interest at a rate equal to LIBO Rate (Reserve Adjusted) plus 2.50% per annum; and the

Revolver A-2 bore interest at a rate equal to LIBO Rate (Reserve Adjusted) plus 2.25% per annum. For purposes

of calculating the interest rate on the Term F Loan, the LIBO Rate (Reserve Adjusted) will always be at least

58