WeightWatchers 2012 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2012 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Holders

The approximate number of holders of record of our common stock as of January 31, 2013 was 295. This

number does not include beneficial owners of our securities held in the name of nominees.

Dividends

We historically have issued a quarterly cash dividend of $0.175 per share of our common stock every

quarter for the past several fiscal years. In the fourth quarter of fiscal 2012, our Board of Directors declared such

a quarterly cash dividend and accelerated its payment to December 2012 instead of having it paid in January

2013 as it has typically done for fourth quarter dividend declarations. Any decision to declare and pay dividends

in the future will be made at the discretion of our Board of Directors, after taking into account our financial

results, capital requirements and other factors it may deem relevant. Our Board of Directors may decide at any

time to increase or decrease the amount of dividends or discontinue the payment of dividends based on these

factors. The WWI Credit Facility (as defined below) also contains restrictions on our ability to pay dividends on

our common stock. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of

Operations—Liquidity and Capital Resources—Long-Term Debt” in Part II, and “Item 15. Exhibits and

Financial Statement Schedules—Financial Statements—Note 6. Long-Term Debt”, of this Annual Report on

Form 10-K for a description of the WWI Credit Facility.

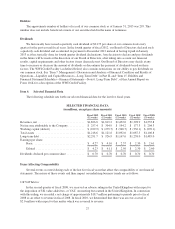

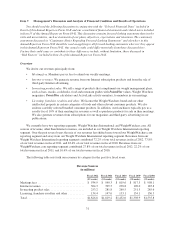

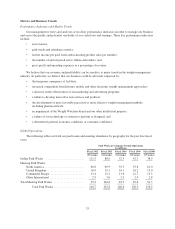

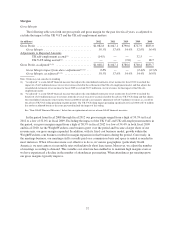

Item 6. Selected Financial Data

The following schedule sets forth our selected financial data for the last five fiscal years.

SELECTED FINANCIAL DATA

(in millions, except per share amounts)

Fiscal 2012

(52 weeks)

Fiscal 2011

(52 weeks)

Fiscal 2010

(52 weeks)

Fiscal 2009

(52 weeks)

Fiscal 2008

(53 weeks)

Revenues, net ................................ $1,826.8 $1,819.2 $1,452.0 $1,398.9 $1,535.8

Net income attributable to the Company ........... $ 257.4 $ 304.9 $ 194.2 $ 177.3 $ 204.3

Working capital (deficit) ....................... $ (229.9) $ (279.7) $ (348.7) $ (336.1) $ (270.1)

Total assets ................................. $1,218.6 $1,121.6 $1,092.0 $1,087.5 $1,106.8

Long-term debt .............................. $2,291.7 $ 926.9 $1,167.6 $1,238.0 $1,485.0

Earnings per share:

Basic .................................. $ 4.27 $ 4.16 $ 2.57 $ 2.30 $ 2.61

Diluted ................................. $ 4.23 $ 4.11 $ 2.56 $ 2.30 $ 2.60

Dividends declared per common share ............ $ 0.70 $ 0.70 $ 0.70 $ 0.70 $ 0.70

Items Affecting Comparability

Several events occurred during each of the last five fiscal years that affect the comparability of our financial

statements. The nature of these events and their impact on underlying business trends are as follows:

UK VAT Matter

In the second quarter of fiscal 2008, we received an adverse ruling in the United Kingdom with respect to

the imposition of UK value added tax, or VAT, on meeting fees earned in the United Kingdom. In connection

with this ruling, we recorded a net charge of approximately $18.7 million pertaining to periods prior to fiscal

2008 as an offset to revenue in fiscal 2008. In fiscal 2010, we determined that there was an over-accrual of

$2.0 million with respect to this matter which was reversed to revenue.

27