WeightWatchers 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Consolidated Results

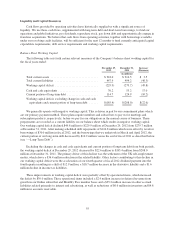

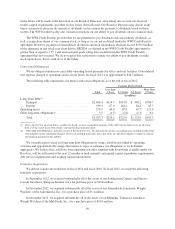

Our revenues increased by $367.2 million, from $1,452.0 million in fiscal 2010 to $1,819.2 million in fiscal

2011, an increase of 25.3%. As noted in the above table, fiscal 2010 results included a benefit to revenue of $2.0

million for a partial accrual reversal of a charge previously recorded in the second quarter of fiscal 2008. As

previously reported, this charge, which reduced revenues in fiscal 2008 for current and prior year periods, and

which has now been paid, was related to an adverse ruling the Company received with respect to the imposition

of UK VAT on meeting fees collected by our UK subsidiary. After adjusting for this charge, fiscal 2011 revenues

increased by $369.2 million, or 25.5%, versus the prior year.

Net income attributable to the Company for fiscal 2011 of $304.9 million increased by $110.6 million, or

57.0%, from $194.2 million in the prior year. On an adjusted basis, net income attributable to the Company

would have been $192.9 million for fiscal 2010 as compared to $304.9 million for fiscal 2011, an increase in

fiscal 2011 of $111.9 million, or 58.0%. Diluted earnings per share of $4.11 for fiscal 2011 increased by $1.55,

or 60.7%, from $2.56 in the prior year. Excluding the $0.02 benefit in fiscal 2010, earnings per fully diluted share

of $2.54 was $1.57, or 61.8%, below the $4.11 of diluted earnings per share in fiscal 2011. Included in the fiscal

2010 diluted earnings per share was a $0.05 charge associated with the previously disclosed settlement of a

California labor litigation.

Revenues

Net revenues were $1,819.2 million in fiscal 2011, an increase of $367.2 million, or 25.3%, from $1,452.0

million in fiscal 2010. After excluding the $2.0 million adjustment to fiscal 2010 revenues for the UK VAT

reversal noted above, revenues increased by $369.2 million, or 25.5%, from the fiscal 2010 adjusted revenues of

$1,450.0 million. Excluding the impact of foreign currency, which increased our revenues in fiscal 2011 by $35.5

million, revenues grew 22.8% versus the prior year. Revenue growth in the period was driven by strong

momentum beginning at the start of fiscal 2011 from the new program launches at the end of fiscal 2010 in our

North American and UK meetings and WeightWatchers.com businesses, and further supported by effective

marketing and public relations activities in these markets in the period.

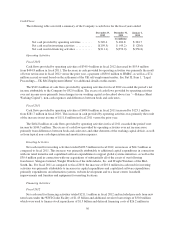

In fiscal 2011, global paid weeks grew 37.3%, global attendance grew 11.9% and end of period active

Online subscribers grew 50.5% in comparison to fiscal 2010, despite weak performance in our Continental

European meetings business. In the first quarter of fiscal 2011, when we launched our marketing campaigns for

the new programs in North America and the United Kingdom, strong enrollments and sign-ups of new and

former customers drove global paid weeks up 39.7%, global attendance up 20.3% and end of period active

Online subscribers up 86.6% versus the prior year period. Growth trends in meeting enrollments and Online sign-

ups moderated somewhat in both the second and third quarters of fiscal 2011 from the historically high levels

experienced in the first quarter of fiscal 2011, but remained strong despite lapping the one-year anniversary of

North America’s successful new marketing strategy launched in the second quarter of fiscal 2010. In the fourth

quarter of fiscal 2011, we continued to experience year-over-year growth versus the prior year period, but at a

slower pace than the first nine months as we lapped the one-year anniversary of the very successful soft launch of

the new program in our English-speaking markets.

Gross Profit and Operating Income

Gross profit in fiscal 2011 of $1,047.1 million increased $256.5 million, or 32.4%, from $790.6 million in

fiscal 2010. Operating income in fiscal 2011 was $546.3 million, an increase of $156.0 million, or 40.0%, from

$390.3 million in fiscal 2010. Our gross margin in fiscal 2011 increased by 310 basis points versus the prior year

to 57.6%, driving operating income margin expansion of 310 basis points versus the prior year to 30.0% in fiscal

2011. Margin expansion was primarily the result of operating leverage gained from higher attendances per

meeting and high growth in our higher margin WeightWatchers.com business. Operating income margin was

compressed slightly as a reduction in selling, general and administrative expenses as a percentage of revenues

was not enough to fully offset an increase in marketing as a percentage of revenues versus the prior year. It

50