WeightWatchers 2012 Annual Report Download - page 51

Download and view the complete annual report

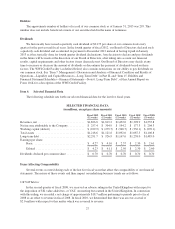

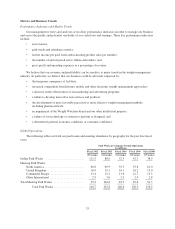

Please find page 51 of the 2012 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.North America Meeting Metrics and Business Trends

In 2008 and 2009, the weak economy in the United States had a significant impact on our meetings

business. The economic recession, coupled with reduced credit availability, adversely impacted consumer

spending. We saw the impact most acutely in enrollments, particularly of new members who had never been to

Weight Watchers. In fiscal 2008, we were able to maintain growth in paid weeks, which increased 4.5% over the

prior year, largely as a result of increased Monthly Pass penetration, but in fiscal 2009, paid weeks declined by

8.4% versus fiscal 2008. Attendance also declined in both years versus the prior year.

In fiscal 2010, NACO meeting paid weeks declined 1.0% and attendance declined 5.7% versus the prior

year as a result of performance weakness in the early part of the year. In the spring of fiscal 2010, NACO

launched a new marketing strategy and campaign focused on member experience, featuring Jennifer Hudson as

its new spokesperson. With this change, business performance began an improvement trend in the second quarter

of fiscal 2010 that continued through the rest of the year. In addition, NACO initiated other growth strategies

during fiscal 2010, including revamping the retail structure in select markets. These new strategies coupled with

the launch of the PointsPlus program in late November resulted in a positive end to fiscal 2010, with solid

growth in the fourth quarter in both paid weeks and attendance, up 4.2% and 6.8%, respectively, versus the fourth

quarter of 2009.

In fiscal 2011, NACO paid weeks increased 26.4% and attendances increased 18.8% versus the prior year

level. We entered fiscal 2011 with more active members than at the beginning of fiscal 2010 driven by the

momentum of the new program launch and supported by strong marketing and public relation activities. The

quarterly growth trend in fiscal 2011 versus prior year quarters continued to be strong, albeit at a slightly slower

pace, as we began to cycle against the highly successful marketing campaign in the second quarter of fiscal 2010

and the soft launch of our new program innovation in the fourth quarter of fiscal 2010. For the first, second, third

and fourth quarters of fiscal 2011, paid weeks increased 32.6%, 31.9%, 25.9% and 15.0% and attendances

increased 33.1%, 19.8%, 13.6% and 5.5%, respectively, as compared to the prior year periods.

In fiscal 2012, NACO paid weeks decreased 5.6% and attendances decreased 11.4% versus the prior year

level. Although we entered fiscal 2012 with more active members than at the beginning of fiscal 2011, we

experienced lower enrollments in the first quarter of fiscal 2012 as we cycled against the historically high levels

of recruitment growth in the first quarter of fiscal 2011. The decline in enrollments in the first quarter of fiscal

2012, caused in part by lack of new program news and execution challenges associated with introducing Monthly

Pass in the small accounts portion of its corporate business, drove a paid weeks decline of 6.0% and an

attendance decline of 11.9%, and also resulted in entering the second quarter of fiscal 2012 with a lower meeting

membership base, as compared to the prior year period. The declining trend in fiscal 2012 continued through the

remainder of the year. For the second, third and fourth quarters of fiscal 2012, paid weeks decreased 5.5%, 3.6%

and 7.3% and attendances decreased 9.9%, 9.4% and 14.5%, respectively, as compared to the prior year periods.

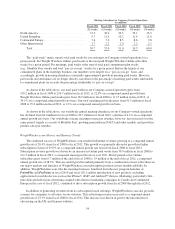

United Kingdom Meeting Metrics and Business Trends

In fiscal 2008, paid weeks grew 17.4% versus the prior year, on the strength of increasing Monthly Pass

penetration. Although the United Kingdom launched a new program in January 2008, full year meeting

attendance declined 2.4% versus the prior year. The UK market responded positively to its new program, but like

the North American market, the United Kingdom experienced a worsening economy over the course of the year

which negatively impacted meeting enrollment and attendance. Economic conditions worsened in 2009, although

effective marketing and promotional activity helped mitigate the negative trend. As a result, paid weeks

continued to improve, up 8.1% in fiscal 2009 as compared to the prior year, reflecting increased penetration of

Monthly Pass in that market, and attendance declined slightly, down 1.5% versus the prior year.

In fiscal 2010, paid weeks growth decelerated by 0.4%, and meeting attendance declined 10.5%, compared

to fiscal 2009. First quarter fiscal 2010 UK volumes were significantly impacted by weather and cycling against

a program innovation in the prior year. The United Kingdom continued to experience steep declines in attendance

in 2010 versus the prior year, down 8.5% in the second quarter and 9.4% in the third quarter. The United

35