WeightWatchers 2012 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2012 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

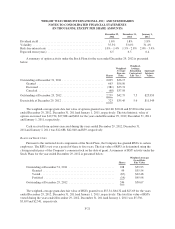

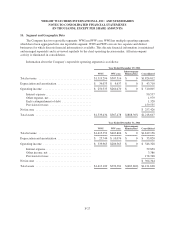

12. Cash Flow Information

December 29,

2012

December 31,

2011

January 1,

2011

Net cash paid during the year for:

Interest expense .......................................... $ 68,808 $ 52,591 $71,602

Income taxes ............................................ $133,131 $144,925 $75,389

Noncash investing and financing activities were as follows:

Fair value of net assets/(liabilities) acquired in connection with

acquisitions ........................................... $ 30,400 $ 0 $ 0

Dividends declared but not yet paid at year-end ................. $ 289 $ 13,145 $13,158

13. Commitments and Contingencies

UK Self-Employment Matter

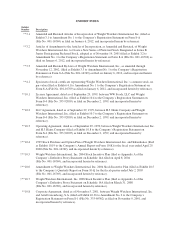

In July 2007, Her Majesty’s Revenue and Customs (“HMRC”) issued to the Company notices of

determination and decisions that, for the period April 2001 to April 2007, its leaders and certain other service

providers in the United Kingdom should have been classified as employees for tax purposes and, as such, it

should have withheld tax from the leaders and certain other service providers pursuant to the “Pay As You Earn”

(“PAYE”) and national insurance contributions (“NIC”) collection rules and remitted such amounts to HMRC.

HMRC also issued a claim to the Company in October 2008 in respect of NIC which corresponds to the prior

notices of assessment with respect to PAYE previously raised by HMRC.

In September 2007, the Company appealed to the UK First Tier Tribunal (Tax Chamber) (formerly known

as the UK VAT and Duties Tribunal and hereinafter referred to as the “First Tier Tribunal”) HMRC’s notices as

to these classifications and against any amount of PAYE and NIC liability claimed to be owed by the Company.

In February 2010, the First Tier Tribunal issued a ruling that the Company’s UK leaders should have been

classified as employees for UK tax purposes and, as such, the Company should have withheld tax from its leaders

pursuant to the PAYE and NIC collection rules for the period from April 2001 to April 2007 with respect to

services performed by the leaders for the Company. The Company appealed the First Tier Tribunal’s adverse

ruling to the UK Upper Tribunal (Tax and Chancery Chamber) (the “Upper Tribunal”), and in October 2011, the

Upper Tribunal issued a ruling dismissing the Company’s appeal. In January 2012, the Company sought

permission from the UK Court of Appeal to appeal the Upper Tribunal’s ruling, which the UK Court of Appeal

refused in March 2012. In March 2012, the Company applied to the UK Court of Appeal for an oral hearing to

seek permission to appeal to the UK Court of Appeal against the Upper Tribunal’s ruling. At the hearing in June

2012, the UK Court of Appeal granted the Company permission to appeal. A hearing date for the appeal was set

for January 2013.

In December 2011, HMRC’s claim in respect of NIC was amended to increase the claimed amount for the

period April 2002 to April 2007 and include the interest accrued thereon through December 2011. In addition, in

February 2012, HMRC asserted a claim in respect of PAYE for the period April 2007 to April 2011 similar to

what it had claimed for the period April 2001 to April 2007. The Company was granted permission to appeal this

PAYE claim with the First Tier Tribunal and the First Tier Tribunal directed that the appeal be stayed until

following the decision of the UK Court of Appeal with respect to the Company’s appeal of the Upper Tribunal’s

ruling.

F-25