WeightWatchers 2012 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2012 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

connection with the Tender Offer and related Artal Holdings share repurchase. See “—Stock Transactions” for a

description of the Tender Offer and the related Artal Holdings share repurchase. In addition, we paid $52.0

million of dividends to our shareholders and received $12.7 million in proceeds from stock options exercised in

fiscal 2012.

Fiscal 2011

Net cash used for financing activities totaled $352.0 million in fiscal 2011 and consisted primarily of

payments on the revolving credit facility of $174.0 million and long-term debt repayments of $139.3 million, as

well as stock repurchases of $34.9 million and dividend payments to our shareholders of $51.6 million.

Offsetting these payments were proceeds from stock options exercised of $42.0 million in fiscal 2011.

Fiscal 2010

Net cash used for financing activities totaled $256.8 million in fiscal 2010 and consisted primarily of stock

repurchases of $106.6 million and dividend payments of $53.4 million, net debt payments of $87.9 million and

deferred financing costs of $11.5 million.

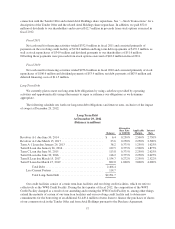

Long-Term Debt

We currently plan to meet our long-term debt obligations by using cash flows provided by operating

activities and opportunistically using other means to repay or refinance our obligations as we determine

appropriate.

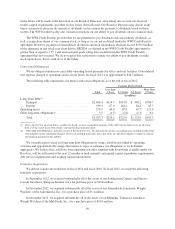

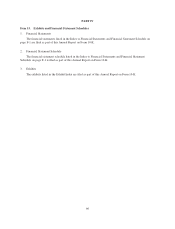

The following schedule sets forth our long-term debt obligations (and interest rates, exclusive of the impact

of swaps) at December 29, 2012:

Long-Term Debt

At December 29, 2012

(Balances in millions)

Balance

Alternative

Base Rate

or LIBOR

Applicable

Margin

Interest

Rate

Revolver A-1 due June 30, 2014 ............................. $ 6.4 0.250% 2.500% 2.750%

Revolver A-2 due March 15, 2017 ............................ 23.6 0.250% 2.250% 2.500%

Term A-1 Loan due January 26, 2013 ......................... 38.2 0.375% 1.250% 1.625%

Term B Loan due January 26, 2014 ........................... 129.5 0.375% 1.500% 1.875%

Term C Loan due June 30, 2015 ............................. 113.8 0.375% 2.250% 2.625%

Term D Loan due June 30, 2016 ............................. 118.2 0.375% 2.250% 2.625%

Term E Loan due March 15, 2017 ............................ 1,154.7 0.272% 2.250% 2.522%

Term F Loan due March 15, 2019 ............................ 822.0 1.000% 3.000% 4.000%

Total Debt ....................................... 2,406.4

Less Current Portion ................................... 114.7

Total Long-Term Debt ............................. $2,291.7

Our credit facilities consist of certain term loan facilities and revolving credit facilities, which we refer to

collectively as the WWI Credit Facility. During the first quarter of fiscal 2012, the composition of the WWI

Credit Facility changed as a result of our amending and restating the WWI Credit Facility to, among other things,

extend the maturity of certain of our term loan facilities and our revolving credit facility and to obtain new

commitments for the borrowing of an additional $1,449.4 million of term loans to finance the purchases of shares

of our common stock in the Tender Offer and from Artal Holdings pursuant to the Purchase Agreement.

57