WeightWatchers 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.recognize expense for all share-based awards based on the fair value of the number of awards we estimate will

fully vest. A change in these underlying assumptions will cause a change in the estimated fair value of share-

based awards and the underlying expense recorded. We continue to evaluate these estimates and assumptions and

believe that these assumptions are appropriate.

RESULTS OF OPERATIONS FOR FISCAL 2012 (52 weeks) COMPARED TO FISCAL 2011 (52 weeks)

OVERVIEW

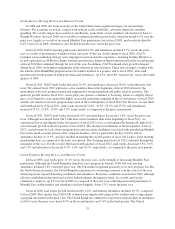

Fiscal 2011 was a year of revenue and volume growth in all fiscal quarters as compared to the prior year

periods. We experienced accelerated period-over-period volume growth in our North American and UK meetings

and Weight Watchers.com businesses throughout the year. The momentum of our new program launches,

PointsPlus in North America and ProPoints in our other English-speaking markets, and strong marketing and

public relations efforts drove this accelerated growth and historically high volumes in fiscal 2011.

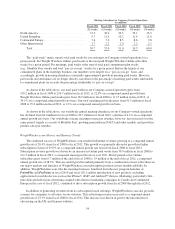

Fiscal 2012 had the challenge of being compared against the high levels of recruitment growth and related

results of fiscal 2011. Fiscal 2012 versus the prior year had similar performance trends as each of the individual

fiscal 2012 quarters. Net revenues were $1,826.8 million in fiscal 2012, as compared to $1,819.2 million in fiscal

2011. Growth in Internet revenues in fiscal 2012 versus the prior year was almost fully offset by revenue declines

in the meetings business. Gross margin for fiscal 2012 grew to 59.3%, including an 80 basis point benefit from

the accrual reversal associated with the settlement of the UK self-employment matter, from 57.6% in fiscal 2011.

Both marketing expenses and selling, general and administrative expenses increased as a percentage of revenue

in fiscal 2012 versus the prior year due to our investments in growth initiatives. As a result, operating income

margin for fiscal 2012, which, like gross margin, also benefited by 80 basis points related to the accrual reversal

associated with the settlement of the UK self-employment matter, declined 2.1% to 28.0% from 30.0% in fiscal

2011. Consequently, and as a result of higher interest expense and a higher tax rate, net income attributable to the

Company in fiscal 2012 declined 15.6% versus the prior year to $257.4 million.

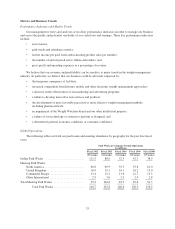

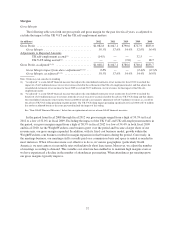

The table below sets forth selected financial information for fiscal 2012 from our consolidated statements of

income for fiscal 2012 versus selected financial information for fiscal 2011 from our consolidated statements of

income for fiscal 2011, on both a reported basis and an adjusted basis. Results for fiscal 2012 are adjusted to

exclude the $4.1 million (after-tax) benefit related to the settlement of the previously disclosed UK self-

employment matter. See “Non-GAAP Financial Measures” above.

42