WeightWatchers 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Liquidity and Capital Resources

Cash flows provided by operating activities have historically supplied us with a significant source of

liquidity. We use these cash flows, supplemented with long-term debt and short-term borrowings, to fund our

operations and global initiatives, pay dividends, repurchase stock, pay down debt and opportunistically engage in

franchise acquisitions. We believe that cash flows from operating activities, together with borrowings available

under our revolving credit facilities, will be sufficient for the next 12 months to fund currently anticipated capital

expenditure requirements, debt service requirements and working capital requirements.

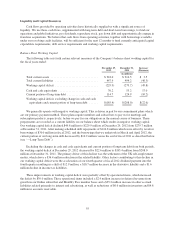

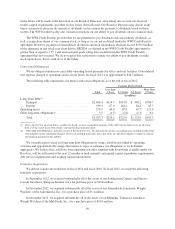

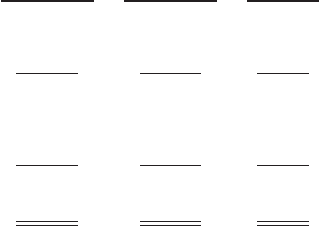

Balance Sheet Working Capital

The following table sets forth certain relevant measures of the Company’s balance sheet working capital for

the fiscal years ended:

December 29,

2012

December 31,

2011

Increase/

(Decrease)

(in millions)

Total current assets ................................ $218.0 $ 214.5 $ 3.5

Total current liabilities ............................. 447.9 494.2 (46.3)

Working capital deficit ............................. (229.9) (279.7) (49.8)

Cash and cash equivalents ........................... 70.2 53.2 17.0

Current portion of long-term debt ..................... 114.7 124.9 (10.2)

Working capital deficit, excluding change in cash and cash

equivalents and current portion of long-term debt ...... $(185.4) $(208.0) $(22.6)

We generally operate with negative working capital. This is driven in part by our commitment plans which

are our primary payment method. These plans require members and subscribers to pay us for meetings and

subscription products, respectively, before we pay for our obligations in the normal course of business. These

prepayments are recorded as a current liability on our balance sheet which results in negative working capital.

Our working capital deficit declined $49.8 million to $229.9 million at December 29, 2012 from $279.7 million

at December 31, 2011. After making scheduled debt repayments of $124.8 million which were offset by revolver

borrowings of $30.0 million in fiscal 2012, and the borrowings that we undertook in March and April 2012, the

current portion of our long-term debt decreased by $10.2 million versus the end of fiscal 2011 as described below

(see “—Long-Term Debt”).

Excluding the changes in cash and cash equivalents and current portion of long-term debt from both periods,

the working capital deficit at December 29, 2012 decreased by $22.6 million to $185.4 million from $208.0

million at December 31, 2011. The primary driver of this decline was the settlement of the UK self-employment

matter, which drove a $36.4 million reduction in the related liability. Other factors contributing to this decline in

our working capital deficit were the acceleration of our fourth quarter of fiscal 2012 dividend payment into the

fourth quarter resulting in a shift of $12.9 million, a $10.7 million decrease in the derivative liability and a $1.6

million decline in income tax liabilities.

These improvements in working capital deficit were partially offset by operational items, which increased

the deficit by $39.0 million. These operational items included a $2.4 million increase in deferred revenue from

growth in our Online subscriber and Monthly Pass member bases and a $25.2 million increase in other accrued

liabilities related primarily to interest and advertising, as well as reductions of $6.6 million in inventory and $4.8

million in accounts receivable.

55