WeightWatchers 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.China Joint Venture

In February 2008, we entered into a joint venture with Groupe DANONE S.A. to establish a weight

management business in the People’s Republic of China. The joint venture, 51% owned by us and 49% owned by

Groupe DANONE, commenced retail operations in China in September 2008.

In April 27, 2011, we acquired the 49% minority equity interest in the joint venture for consideration of

$1,000. Effective the date of the acquisition of the minority equity interest, we own 100% of the joint venture.

Stock Transactions

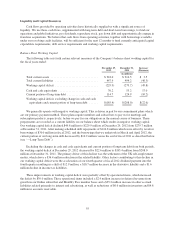

On October 9, 2003, our Board of Directors authorized and we announced a program to repurchase up to

$250.0 million of our outstanding common stock. On each of June 13, 2005, May 25, 2006 and October 21, 2010,

our Board of Directors authorized and we announced adding $250.0 million to this program. The repurchase

program allows for shares to be purchased from time to time in the open market or through privately negotiated

transactions. No shares will be purchased from Artal Holdings and its parents and subsidiaries under this

program. The repurchase program currently has no expiration date. During the twelve months ended

December 29, 2012, the Company repurchased no shares of its common stock in the open market under this

program. The repurchase of shares of common stock under the Tender Offer and from Artal Holdings pursuant to

the Purchase Agreement, as discussed further below, was not made pursuant to the repurchase program. During

the twelve months ended December 31, 2011, the Company repurchased in its first quarter 0.8 million shares of

its common stock in the open market under this program for a total cost of $31.6 million, and in its second, third

and fourth quarters no shares of its common stock under this program.

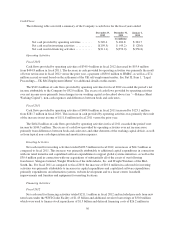

On February 23, 2012, we commenced a “modified Dutch auction” tender offer for up to $720.0 million in

value of our common stock at a purchase price not less than $72.00 and not greater than $83.00 per share, or the

Tender Offer. Prior to the Tender Offer, on February 14, 2012, we entered into an agreement, or the Purchase

Agreement, with Artal Holdings whereby Artal Holdings agreed to sell to us, at the same price as was determined

in the Tender Offer, such number of its shares of our common stock that, upon the closing of this purchase after

the completion of the Tender Offer, Artal Holdings’ percentage ownership in the outstanding shares of our

common stock would be substantially equal to its level prior to the Tender Offer. Artal Holdings also agreed not

to participate in the Tender Offer so that it would not affect the determination of the purchase price of the shares

in the Tender Offer.

The Tender Offer expired at midnight, New York time, on March 22, 2012, and on March 28, 2012 we

repurchased approximately 8.8 million shares at a purchase price of $82.00 per share. On April 9, 2012, we

repurchased approximately 9.5 million of Artal Holdings’ shares at a purchase price of $82.00 per share pursuant

to the Purchase Agreement. In March 2012, we amended and extended the WWI Credit Facility to finance these

repurchases. See “—Long-Term Debt”.

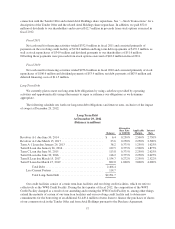

The WWI Credit Facility provides that we are permitted to pay dividends and extraordinary dividends, as

well as repurchase shares of our common stock, so long as we are not in default under the WWI Credit Facility

agreement. However, payment of extraordinary dividends and stock repurchases shall not exceed $150.0 million

in the aggregate in any fiscal year if net debt to EBITDA (as defined in the WWI Credit Facility agreement) is

equal to or greater than 3.75:1 and an investment grade rating date (as defined in the WWI Credit Facility

agreement) has not occurred. We currently do not expect this restriction to impair our ability to pay dividends or

make stock repurchases, but it could do so in the future.

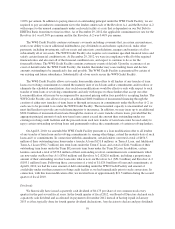

Factors Affecting Future Liquidity

Any future acquisitions, joint ventures or other similar transactions could require additional capital and we

cannot be certain that any additional capital will be available on acceptable terms or at all. Our ability to fund our

capital expenditure requirements, interest, principal and dividend payment obligations and working capital

61