WeightWatchers 2002 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

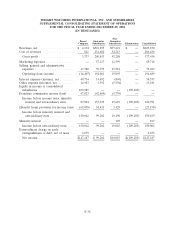

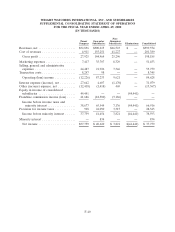

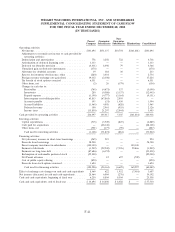

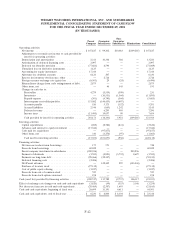

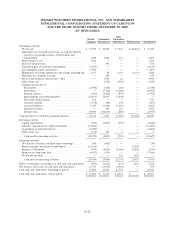

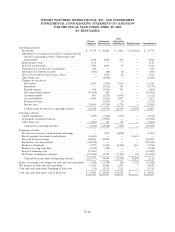

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

SUPPLEMENTAL CONSOLIDATING STATEMENT OF CASH FLOW

FOR THE FISCAL YEAR ENDED APRIL 29, 2000

(IN THOUSANDS)

Non-

Parent Guarantor Guarantor

Company Subsidiaries Subsidiaries Eliminations Consolidated

Operating activities:

Net income .............................. $ 37,759 $ 40,620 $ 3,821 $ (44,441) $ 37,759

Adjustments to reconcile net income to cash provided by

(used for) operating activities: Depreciation and

amortization ............................ 2,326 6,028 932 —9,286

Bond issuance costs ......................... 1,112 —— —1,112

Deferred tax provision ........................ 3,785 4,685 71 —8,541

Unrealized loss on derivative instruments ............ 499 —— —499

Allowance for doubtful accounts ................. (352) (29) (4) —(385)

Reserve for inventory obsolescence, other ........... —3,332 28 —3,360

Other items, net ........................... —(2,492) ——(2,492)

Changes in cash due to:

Receivables ............................. 5,205 (1,295) 9,514 — 13,424

Inventories ............................. — (5,453) 276 — (5,177)

Prepaid expense .......................... 108 (1,691) 782 — (801)

Due from related parties ..................... (15,149) 384 ——(14,765)

Accounts payable ......................... 807 (1,272) (1,047) —(1,512)

Accrued liabilities ......................... 4,039 (1,845) 3,087 — 5,281

Deferred revenue ......................... (1,827) 74 —(1,753)

Income taxes ............................ 90,650 (97,918) 4,776 — (2,492)

Cash provided by (used for) operating activities ...... 130,789 (58,773) 22,310 (44,441) 49,885

Investing activities:

Capital expenditures ......................... (299) (1,004) (571) —(1,874)

Acquisitions of minority interest ................. —(15,900) ——(15,900)

Other items, net ........................... (2,067) 116 84 — (1,867)

Cash used for investing activities ................ (2,366) (16,788) (487) —(19,641)

Financing activities:

Net increase (decrease) in short-term borrowings ....... — 1,235 (6,690) — (5,455)

Parent company investment in subsidiaries ........... (34,693) ——34,693 —

Proceeds from borrowings ..................... 404,260 87,000 ——491,260

Repurchase of common stock ................... (324,476) —— —(324,476)

Payment of dividends ........................ (2,797) (3,120) (4,494) 7,615 (2,796)

Payments on long-term debt .................... (3,312) (218) ——(3,530)

Deferred financing costs ...................... (15,861) —— —(15,861)

Net Parent (settlements) advances ................ (138,998) 14,552 (7,175) 591 (131,030)

Cash (used for) provided by financing activities ...... (115,877) 99,449 (18,359) 42,899 8,112

Effect of exchange rate changes on cash and cash equivalents (1,488) (13,799) (83) 1,542 (13,828)

Net increase in cash and cash equivalents ............. 11,058 10,089 3,381 —24,528

Cash and cash equivalents, beginning of fiscal year ....... (74) 12,376 7,213 —19,515

Cash and cash equivalents, end of fiscal year ........... $ 10,984 $ 22,465 $ 10,594 $ —$ 44,043

F-44