WeightWatchers 2002 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

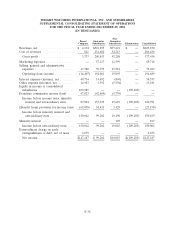

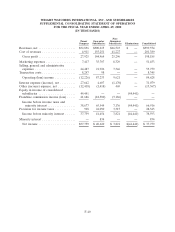

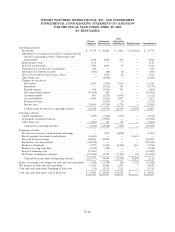

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

SUPPLEMENTAL CONSOLIDATING STATEMENT OF CASH FLOW

FOR THE EIGHT MONTHS ENDED DECEMBER 30, 2000

(IN THOUSANDS)

Non-

Parent Guarantor Guarantor

Company Subsidiaries Subsidiaries Eliminations Consolidated

Operating activities:

Net income .............................. $ 15,019 $ 23,085 $ 3,536 $ (26,621) $ 15,019

Adjustments to reconcile net income to cash provided by

(used for) operating activities: Depreciation and

amortization ............................ 1,930 4,266 411 —6,607

Bond issuance costs ......................... 1,282 —— —1,282

Deferred tax provision ........................ —104 ——104

Unrealized gain on derivative instruments ........... (5,815) —— —(5,815)

Accounting for equity investment ................. 17,604 —— —17,604

Elimination of foreign subsidiaries one month reporting lag 1,137 86 1,120 (1,137) 1,206

Allowance for doubtful accounts ................. —198 ——198

Reserve for inventory obsolescence, other ........... —3,981 12 —3,993

Other items, net ........................... (532) (422) —(954)

Changes in cash due to:

Receivables ............................. (2,096) (566) (84) —(2,746)

Inventories ............................. —(7,214) (1,688) —(8,902)

Prepaid expense .......................... (213) (2,422) (957) —(3,592)

Intercompany receivables/payables ............... (21,193) 24,595 (3,402) ——

Due from related parties ..................... 241 —— — 241

Accounts payable ......................... (1,072) (69) 838 —(303)

Accrued liabilities ......................... 9,327 (1,450) (1,015) — 6,862

Deferred revenue ......................... —858 185 —1,043

Income taxes ............................ 38,960 (41,643) (292) — (2,975)

Cash provided by (used for) operating activities ......... 55,111 3,277 (1,758) (27,758) 28,872

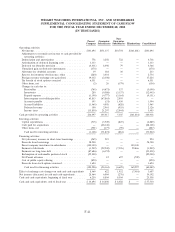

Investing activities:

Capital expenditures ......................... (100) (3,017) (509) —(3,626)

Advances and interest to equity investment .......... (15,604) —— —(15,604)

Acquisitions of minority interest ................. (2,400) —— —(2,400)

Other items, net ........................... (148) 147 4 — 3

Cash used for investing activities ................ (18,252) (2,870) (505) —(21,627)

Financing activities:

Net increase (decrease) in short-term borrowings ....... 566 (600) ——(34)

Parent company investment in subsidiaries ........... (13,556) ——13,556 —

Payment of dividends ........................ (879) (8,834) (1,968) 10,802 (879)

Payments on long-term debt .................... (6,625) (435) ——(7,060)

Net Parent advances ......................... ——421 (421) —

Cash used for financing activities ............... (20,494) (9,869) (1,547) 23,937 (7,973)

Effect of exchange rate changes on cash and cash equivalents (650) (1,812) (173) 3,821 1,186

Net increase (decrease) in cash and cash equivalents ...... 15,715 (11,274) (3,983) — 458

Cash and cash equivalents, beginning of period ......... 10,984 22,465 10,594 —44,043

Cash and cash equivalents, end of period ............. $ 26,699 $ 11,191 $ 6,611 $ —$ 44,501

F-43