WeightWatchers 2002 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

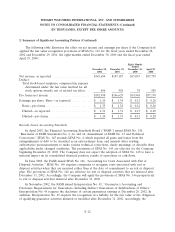

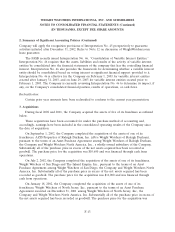

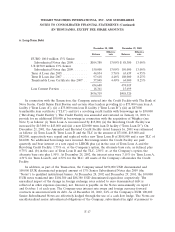

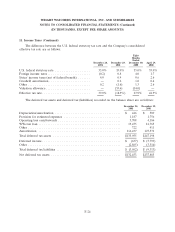

6. Long-Term Debt

December 28, 2002 December 29, 2001

Effective Effective

Balance rate Balance rate

EURO 100.0 million 13% Senior

Subordinated Notes due 2009 ........ $104,380 13.00% $ 88,380 13.00%

US $150.0 million 13% Senior

Subordinated Notes due 2009 ........ 150,000 13.00% 150,000 13.00%

Term A Loan due 2005 .............. 44,834 3.76% 63,639 6.95%

Term B Loan due 2007 .............. 97,618 4.46% 108,000 8.25%

Transferable Loan Certificate due 2007 . . 57,848 4.40% 64,000 8.25%

454,680 474,019

Less Current Portion ............... 18,361 15,699

$436,319 $458,320

In connection with the Transaction, the Company entered into the Credit Facility with The Bank of

Nova Scotia, Credit Suisse First Boston and certain other lenders providing (i) a $75,000 term loan A

facility (‘‘Term Loan A’’), (ii) a $75,000 term loan B facility (‘‘Term Loan B’’), (iii) an $87,000

transferable loan certificate (‘‘TLC’’) and (iv) a revolving credit facility with borrowings up to $30,000

(‘‘Revolving Credit Facility’’). The Credit Facility was amended and restated on January 16, 2001 to

provide for an additional $50,000 in borrowings in connection with the acquisition of Weighco (see

Note 3) as follows: (i) Term Loan A was increased by $15,000, (ii) the Revolving Credit Facility was

increased by $15,000 to $45,000 and (iii) a new $20,000 term loan D facility (‘‘Term Loan D’’). On

December 21, 2001, the Amended and Restated Credit Facility dated January 16, 2001 was refinanced

as follows: (i) Term Loan B, Term Loan D and the TLC in the amount of $71,000, $19,000 and

$82,000, respectively were repaid and replaced with a new Term Loan B of $108,000 and a new TLC of

$64,000. No additional borrowings were incurred. Borrowings under the Credit Facility are paid

quarterly and bear interest at a rate equal to LIBOR plus (a) in the case of Term Loan A and the

Revolving Credit Facility, 1.75% or, at the Company’s option, the alternate base rate, as defined, plus

0.75% and, (b) in the case of Term Loan B and the TLC, 2.50% or, at the Company’s option, the

alternate base rate plus 1.50%. At December 28, 2002, the interest rates were 3.15% for Term Loan A,

4.31% for Term Loan B, and 4.32% for the TLC. All assets of the Company collateralize the Credit

Facility.

In addition, as part of the Transaction, the Company issued $150,000 USD denominated and

100,000 EUR denominated principal amount of 13% Senior Subordinated Notes due 2009 (the

‘‘Notes’’) to qualified institutional buyers. At December 28, 2002 and December 29, 2001, the 100,000

EUR notes translated into $104,380 and $88,380 USD denominated equivalent, respectively. The

unrealized impact of the change in foreign exchange rates related to euro denominated debt is

reflected in other expenses (income), net. Interest is payable on the Notes semi-annually on April 1

and October 1 of each year. The Company uses interest rate swaps and foreign currency forward

contracts in association with its debt. As of December 28, 2002, 24% of the Company’s EUR 100,000

Senior Subordinated Notes are effectively hedged through the use of a cash flow hedge. The Notes are

uncollateralized senior subordinated obligations of the Company, subordinated in right of payment to

F-17