WeightWatchers 2002 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

2. Summary of Significant Accounting Policies (Continued)

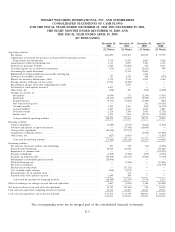

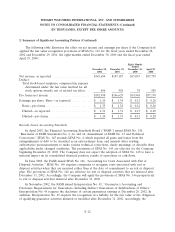

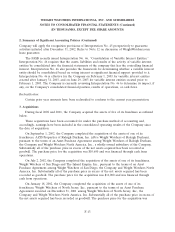

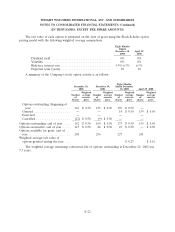

The following table illustrates the effect on net income and earnings per share if the Company had

applied the fair value recognition provisions of SFAS No. 123 for the fiscal years ended December 28,

2002 and December 29, 2001, the eight months ended December 30, 2000 and the fiscal year ended

April 29, 2000:

Eight Months

Ended

December 28, December 29, December 30, April 29,

2002 2001 2000 2000

Net income, as reported ..................... $143,694 $147,187 $15,019 $37,759

Deduct:

Total stock-based employee compensation expense

determined under the fair value method for all

stock options awards, net of related tax effect . . 696 558 35 589

Pro forma net income ....................... $142,998 $146,629 $14,984 $37,170

Earnings per share: Basic—as reported .......... $ 1.35 $ 1.34 $ 0.13 $ 0.20

Basic—pro forma ........................ $ 1.35 $ 1.34 $ 0.12 $ 0.20

Diluted—as reported...................... $ 1.31 $ 1.31 $ 0.13 $ 0.20

Diluted—pro forma ...................... $ 1.30 $ 1.31 $ 0.13 $ 0.20

Recently Issued Accounting Standards:

In April 2002, the Financial Accounting Standards Board (‘‘FASB’’) issued SFAS No. 145,

‘‘Rescission of FASB Statements No. 4, 44, and 64, Amendment of FASB No. 13 and Technical

Corrections.’’ SFAS No. 145 rescinds SFAS No. 4, which required all gains and losses from the

extinguishment of debt to be classified as an extraordinary item, and amends other existing

authoritative pronouncements to make various technical corrections, clarify meanings, or describe their

applicability under changed conditions. The provisions of SFAS No. 145 are effective for the Company

beginning December 29, 2002. The Company does not expect the adoption of SFAS No. 145 to have a

material impact on its consolidated financial position, results of operations or cash flows.

In June 2002, the FASB issued SFAS No. 146, ‘‘Accounting for Costs Associated with Exit or

Disposal Activities.’’ SFAS No. 146 requires companies to recognize costs associated with exit or

disposal activities when they are incurred rather than at the date of commitment to an exit or disposal

plan. The provisions of SFAS No. 146 are effective for exit or disposal activities that are initiated after

December 31, 2002. Accordingly, the Company will apply the provisions of SFAS No. 146 prospectively

to exit or disposal activities initiated after December 31, 2002.

In November 2002, the FASB issued Interpretation No. 45, ‘‘Guarantor’s Accounting and

Disclosure Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others.’’

Interpretation No. 45 requires the disclosure of certain guarantees existing at December 28, 2002. In

addition, Interpretation No. 45 requires the recognition of a liability for the fair value of the obligation

of qualifying guarantee activities initiated or modified after December 31, 2002. Accordingly, the

F-12