WeightWatchers 2002 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

6. Long-Term Debt (Continued)

all existing and future senior indebtedness of the Company, including the Credit Facility. The notes are

guaranteed by certain subsidiaries of the Company.

The Credit Facility and the Notes contain a number of covenants that, among other things, restrict

the Company’s ability to dispose of assets, incur additional indebtedness, or engage in certain

transactions with affiliates and otherwise restrict the Company’s corporate activities. In addition, under

the Credit Facility, the Company is required to comply with specified financial ratios and tests,

including minimum fixed charge coverage and interest coverage ratios and maximum leverage ratios.

The Credit Facility and the Notes also restrict the Company’s ability to pay dividends and redeem the

Notes.

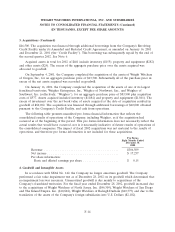

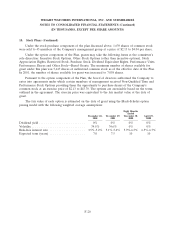

The aggregate amounts of existing long-term debt maturing in each of the next five years and

thereafter are as follows:

2003 ................................................... $18,361

2004 ................................................... 16,055

2005 ................................................... 15,511

2006 ................................................... 1,567

2007 ................................................... 148,806

2008 and thereafter ........................................ 254,380

$454,680

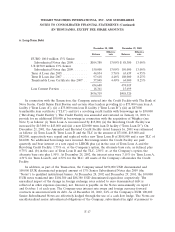

7. Redeemable Preferred Stock

The Company issued one million shares of Series A Preferred Stock to Heinz in conjunction with

the Transaction. On March 1, 2002, the Company redeemed from Heinz all of the Company’s Series A

Preferred Stock for a redemption price of $25,000 plus accrued and unpaid dividends. The redemption

was financed through additional borrowings of $12,000 under the Revolving Credit Facility, which was

repaid by the end of the second quarter 2002, and cash from operations.

8. Treasury Stock

On April 18, 2001, the Company entered into a Put/Call Agreement with Heinz, pursuant to which

Heinz acquired the right and option to sell during the period ending on or before May 15, 2002, and

the Company acquired the right and option to purchase after that date and on or before August 15,

2002, 6,719 shares of the common stock of the Company owned by Heinz. Under this agreement,

during the fiscal year ended December 29, 2001, Heinz sold all of its shares to the Company at fair

value for an aggregate purchase price of $27,132, which was funded with cash from operations. Heinz

no longer holds any common stock of the Company.

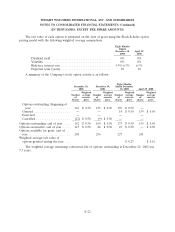

9. Earnings Per Share

Basic earnings per share (‘‘EPS’’) computations are calculated utilizing the weighed average

number of common shares outstanding during the periods presented. Diluted EPS includes the

F-18