WeightWatchers 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

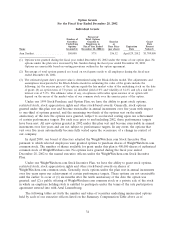

December 28, 2002. None of our executive officers exercised any WeightWatchers.com options and they

do not have any stock appreciation rights.

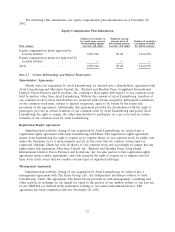

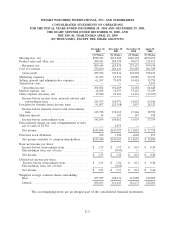

Aggregated Options

Values as of December 28, 2002

Fiscal Year Ended Number of Weight Watchers Value of Weight Watchers

December 28, 2002 Securities Unexercised

Shares Underlying Unexercised Options at In-The-Money Options at

December 28, 2002 December 28, 2002

Acquired in Value

Name Exercise (#) Realized Exercisable (#) Unexercisable (#) Exercisable Unexercisable

Linda Huett ............ ——308,202 115,281 $13,322,031 $4,983,021

Ann M. Sardini ......... ———100,000 —$ 903,000

Richard McSorley ........ 12,350 $470,257 100,579 169,393 $ 4,155,120 $6,997,964

Clive Brothers .......... 20,000 $799,800 182,331 79,991 $ 7,881,257 $3,457,611

Robert W. Hollweg ....... ——202,331 79,991 $ 8,745,757 $3,457,611

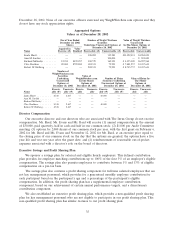

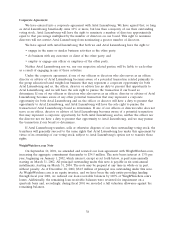

Number of

WeightWatchers.com

Securities Value of

Underlying WeightWatchers.com Number of Heinz Value of Heinz In-

Unexercised In-The-Money Securities Underlying The-Money

Options at Options at Unexercised Options at Options at

December 28, 2002 December 28, 2002 December 28, 2002 December 28, 2002

Exercis- Unexercis- Exercis- Unexercis- Exercis- Unexercis- Exercis- Unexercis-

Name able (#) able (#) able able able (#) able (#) able able

Linda Huett ......... 8,538 2,847 ——40,000 ———

Ann M. Sardini ....... ———— — — ——

Richard McSorley ..... ———— — — ——

Clive Brothers ........ 8,538 2,847 ——40,000 ———

Robert W. Hollweg ..... 8,538 2,847 —— — — ——

Director Compensation

Our executive director and our directors who are associated with The Invus Group do not receive

compensation. Mr. Reed, Ms. Evans and Mr. Bard will receive (1) annual compensation in the amount

of $30,000, paid quarterly, half in cash and half in our common stock; (2) $1,000 per Audit Committee

meeting; (3) options for 2,000 shares of our common stock per year, with the first grant on February 6,

2002 for Mr. Reed and Ms. Evans and November 12, 2002 for Mr. Bard, at an exercise price equal to

the closing price of our common stock on the day that the options are granted, the options have a five

year life and vest one year after the grant date; and (4) reimbursement of reasonable out-of-pocket

expenses associated with a director’s role on the board of directors.

Executive Savings and Profit Sharing Plan

We sponsor a savings plan for salaried and eligible hourly employees. This defined contribution

plan provides for employer matching contributions up to 100% of the first 3% of an employee’s eligible

compensation. The savings plan also permits employees to contribute between 1% and 13% of eligible

compensation on a pre-tax basis.

The savings plan also contains a profit sharing component for full-time salaried employees that are

not key management personnel, which provides for a guaranteed monthly employer contribution for

each participant based on the participant’s age and a percentage of the participant’s eligible

compensation. In addition, the profit sharing plan has a supplemental employer contribution

component, based on our achievement of certain annual performance targets, and a discretionary

contribution component.

We also established an executive profit sharing plan, which provides a non-qualified profit sharing

plan for key management personnel who are not eligible to participate in our profit sharing plan. This

non-qualified profit sharing plan has similar features to our profit sharing plan.

35