WeightWatchers 2002 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

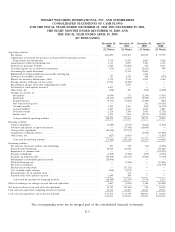

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

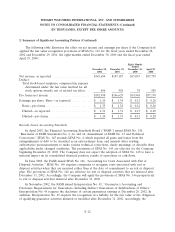

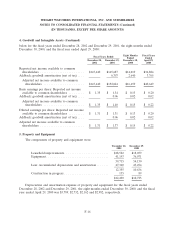

2. Summary of Significant Accounting Policies (Continued)

Income Taxes:

The Company provides for taxes based on current taxable income and the future tax consequences

of temporary differences between the financial reporting and income tax carrying values of its assets

and liabilities. Under SFAS No. 109, ‘‘Accounting for Income Taxes’’, assets and liabilities acquired in

purchase business combinations are assigned their fair values and deferred taxes are provided for lower

or higher tax bases.

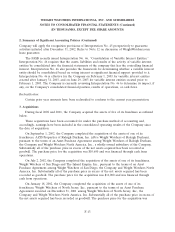

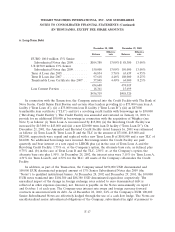

Derivative Instruments and Hedging:

The Company enters into forward and swap contracts to hedge transactions denominated in

foreign currencies to reduce the currency risk associated with fluctuating exchange rates. These

contracts are used primarily to hedge certain inter-company cash flows and for payments arising from

some of the Company’s foreign currency denominated obligations. In addition, the Company enters

into interest rate swaps to hedge a substantial portion of its variable rate debt.

Effective December 31, 2000, the Company adopted SFAS No. 133, ‘‘Accounting for Derivative

Instruments and Hedging Activities,’’ and its related amendment, SFAS No. 138, ‘‘Accounting for

Certain Derivative Instruments and Certain Hedging Activities’’. These standards require that all

derivative financial instruments be recorded on the consolidated balance sheets at their fair value as

either assets or liabilities. Changes in the fair value of derivatives will be recorded each period in

earnings or accumulated other comprehensive income (loss), depending on whether a derivative is

designated and effective as part of a hedge transaction and, if it is, the type of hedge transaction. Gains

and losses on derivative instruments reported in accumulated other comprehensive income (loss) will be

included in earnings in the periods in which earnings are affected by the hedged item. As of

December 31, 2000, the adoption of these new standards resulted in an adjustment of $5,086 ($3,204

net of taxes) to accumulated other comprehensive loss.

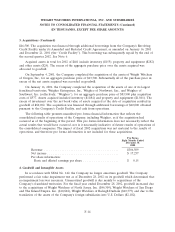

Investments:

The Company uses the cost method to account for investments in which the Company holds 20%

or less of the investee’s voting stock and the Company does not have significant influence. Where the

Company holds 50% or less of the investee’s voting stock or where the Company has the ability to

exercise significant influence over operating and financial policies of the investee, the investment is

accounted for under the equity method.

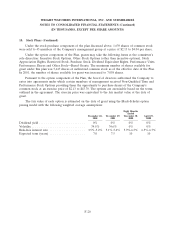

Deferred Financing Costs:

Deferred financing costs consist of costs associated with the establishment of the Company’s credit

facilities resulting from the Transaction. During the fiscal year ended December 29, 2001, the Company

incurred additional deferred financing costs of $2,406 associated with the Weighco acquisition and

refinancing of its credit facilities. Such costs are being amortized using the interest rate method over

the term of the related debt. Amortization expense for the fiscal years ended December 28, 2002 and

December 29, 2001, the eight months ended December 30, 2000 and the fiscal year ended April 29,

2000 was $1,313, $2,097, $1,282 and $1,112, respectively. In connection with the refinancing of its credit

F-10