WeightWatchers 2002 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

Heinz Sponsored Plans—Prior to the Transaction:

Domestic employees participated in certain defined pension plans, a defined contribution 401(k)

savings plan and, for employees affected by certain IRS limits, a section 415 Excess Plan, all of which

are sponsored by Heinz. The Company also provided post-retirement health care and life insurance

benefits for employees who meet the eligibility requirements of the Heinz plans. Retirees share in the

cost of these benefits based on age and years of service.

Company contributions to the Heinz Savings Plan include a qualified age-related contribution and

a matching of the employee’s contribution, up to a specified amount.

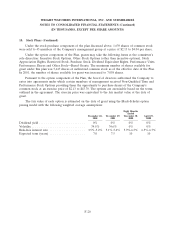

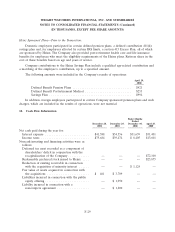

The following amounts were included in the Company’s results of operations:

April 29,

2000

Defined Benefit Pension Plans ................................. $421

Defined Benefit Postretirement Medical .......................... $253

Savings Plan .............................................. $994

In addition, foreign employees participated in certain Company sponsored pension plans and such

charges, which are included in the results of operations, were not material.

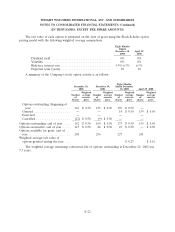

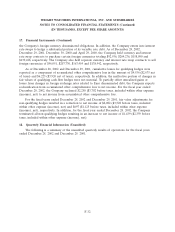

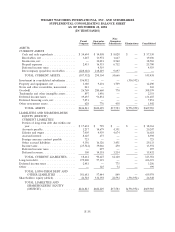

14. Cash Flow Information

Eight Months

Ended

December 28, December 29, December 30, April 29,

2002 2001 2000 2000

Net cash paid during the year for:

Interest expense ......................... $41,588 $54,556 $31,639 $31,401

Income taxes ........................... $75,684 $39,474 $8,405 $13,601

Noncash investing and financing activities were as

follows:

Deferred tax asset recorded as a component of

shareholders’ deficit in conjunction with the

recapitalization of the Company ............ ———$72,100

Redeemable preferred stock issued to Heinz . . . . ———$25,875

Reduction of existing receivable in connection

with the acquisition of minority interest ...... ——$ 1,124 —

Fair value of assets acquired in connection with

the acquisitions ........................ $ 461 $ 3,709 ——

Liabilities incurred in connection with the public

equity offering......................... —$ 1,950 ——

Liability incurred in connection with a

noncompete agreement .................. —$ 1,200 ——

F-29