WeightWatchers 2002 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

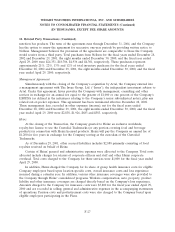

12. Related Party Transactions (Continued)

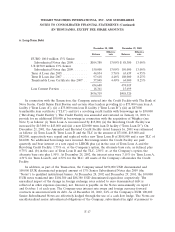

Loan Agreement:

Pursuant to the amended loan agreement dated September 20, 2001 between the Company and

WeightWatchers.com, through fiscal year 2001, the Company provided loans to WeightWatchers.com

aggregating $34,500. The Company has no further obligation to provide funding to

WeightWatchers.com. Beginning on January 1, 2002, the note bears interest at 13% per year and

beginning March 31, 2002, interest has been and shall be paid to the Company semi-annually. All

principal outstanding under the agreement is payable in six semi-annual installments commencing on

March 31, 2004. For the year ended December 28, 2002, the Company recorded interest income of

$4,454 on the note. As of December 28, 2002, the interest receivable balance was $1,106, and is

included within receivables, net. As WeightWatchers.com is an equity investee, and the Company has

been the only entity providing funding through fiscal year 2001, the Company reduced its loan

receivable balances by 100% of WeightWatchers.com’s losses. Additionally, the remaining loan

receivable balances were reviewed for impairment on a quarterly basis and, accordingly, during fiscal

2001 the Company recorded a full valuation allowance against the remaining balances.

Intellectual Property License:

The Company entered into an amended and restated intellectual property license agreement dated

September 29, 2001 with WeightWatchers.com. In fiscal 2002, the Company began earning royalties

pursuant to the agreement. For the year ended December 28, 2002, the Company recorded royalty

income of $4,175 which was included in product sales and other, net. As of December 28, 2002, the

receivable balance was $1,280 and is included within receivables, net.

Service Agreement:

Simultaneously with the signing of the amended and restated intellectual property license

agreement, the Company entered into a service agreement with WeightWatchers.com, under which

WeightWatchers.com provides certain types of services. The Company is required to pay for all

expenses incurred by WeightWatchers.com directly attributable to the services it performs under this

agreement, plus a fee of 10% of those expenses. The Company recorded service expense for the year

ended December 28, 2002 of $1,862 and $554 for the year ended December 29, 2001, all of which was

included in marketing expenses. The accrued service payable at December 28, 2002 and December 29,

2001 was $484 and $554, respectively, and is netted against receivables, net.

Lease Guarantee:

The Company has guaranteed the performance of part of WeightWatchers.com’s lease of its office

space at 888 Seventh Avenue, New York, New York. The annual rent is $459 plus increases for

operating expenses and real estate taxes. The lease expires in September 2003.

Nellson Agreement:

On November 30, 1999, the Company entered into an agreement with Nellson Neutraceutical, Inc.

(‘‘Nellson’’), which up until October 4, 2002 was a wholly-owned subsidiary of Artal, to purchase

nutrition bar products manufactured by Nellson for sale at the Company’s meetings. Under the

agreement, Nellson agrees to produce sufficient nutrition bar products to fill the Company’s purchase

orders within 30 days of receipt. The Company is not bound to purchase a minimum quantity of

F-26