WeightWatchers 2002 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

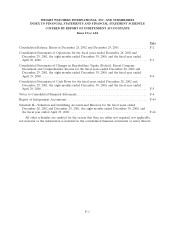

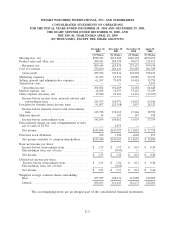

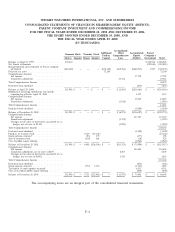

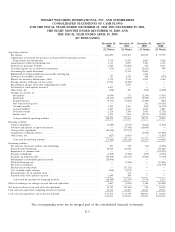

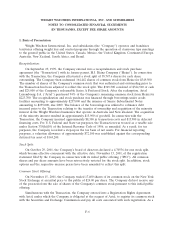

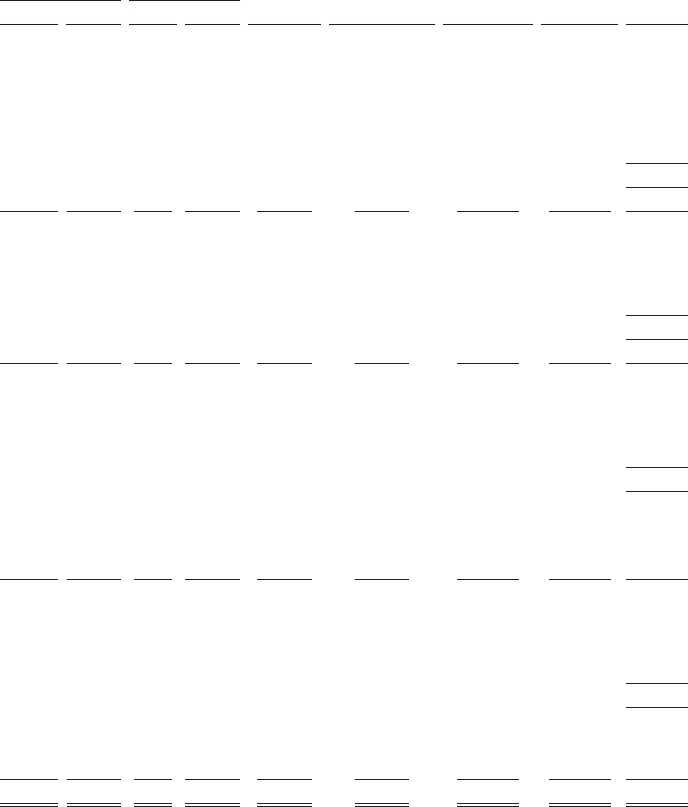

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (DEFICIT),

PARENT COMPANY INVESTMENT AND COMPREHENSIVE INCOME

FOR THE FISCAL YEARS ENDED DECEMBER 28, 2002 AND DECEMBER 29, 2001,

THE EIGHT MONTHS ENDED DECEMBER 30, 2000, AND

THE FISCAL YEAR ENDED APRIL 29, 2000

(IN THOUSANDS)

Accumulated

Additional Other Accumulated Parent

Common Stock Treasury Stock Paid-in Comprehensive Equity Company’s

Shares Amount Shares Amount Capital Loss (Deficit) Investment Total

Balance at April 24, 1999 .................. 276,430 $ 248,948 $ 248,948

Net Parent settlements ................... (252,883) (252,883)

Recapitalization and settlement of Parent company

investment ......................... (164,442) —— —$(72,100) $(12,764) $(268,547) 3,935 (349,476)

Deferred tax asset ...................... 72,100 72,100

Comprehensive Income:

Net income ......................... 37,759 37,759

Translation adjustment .................. 10,311 10,311

Total Comprehensive Income ................ 48,070

Preferred stock dividend .................. (875) (875)

Balance at April 29, 2000 .................. 111,988 $ ——$ — $ — $ (2,453) $(231,663) $ —$(234,116)

Elimination of foreign subsidiaries one month

reporting lag effective April 30, 2000 ......... 1,137 1,137

Comprehensive Income:

Net income ......................... 15,019 15,019

Translation adjustment .................. (3,818) (3,818)

Total Comprehensive Income ................ 11,201

Preferred stock dividend .................. (1,000) (1,000)

Balance at December 30, 2000 ............... 111,988 $ ——$ — $ — $ (6,271) $(216,507) $ —$(222,778)

Comprehensive Income:

Net income ......................... 147,187 147,187

Translation adjustment .................. (3,132) (3,132)

Changes in fair value of derivatives accounted for as

hedges, net of taxes of $2,303 ............ (3,920) (3,920)

Total Comprehensive Income ................ 140,135

Preferred stock dividend .................. (1,500) (1,500)

Purchase of treasury stock ................. 6,719 (27,132) (27,132)

Stock options exercised ................... (93) 375 (177) 198

Sale of common stock .................... (138) 561 (36) 525

Cost of public equity offering ............... (2,965) (2,965)

Balance at December 29, 2001 ............... 111,988 $ — 6,488 $(26,196) $ —$(13,323) $ (73,998) $ —$(113,517)

Comprehensive Income:

Net income ......................... 143,694 143,694

Translation adjustment, net of taxes of $835 ..... 8,205 8,205

Changes in fair value of derivatives accounted for as

hedges, net of taxes of $(443) ............ 1,245 1,245

Total Comprehensive Income ................ 153,144

Preferred stock dividend .................. (254) (254)

Stock options exercised ................... (777) 3,135 (1,441) 1,694

Tax benefit of stock options exercised .......... 6,331 6,331

Cost of secondary public equity offering ......... (850) (850)

Balance at December 28, 2002 ............... 111,988 $ — 5,711 $(23,061) $ —$ (3,873) $ 73,482 $ — $ 46,548

The accompanying notes are an integral part of the consolidated financial statements.

F-4