WeightWatchers 2002 Annual Report Download - page 27

Download and view the complete annual report

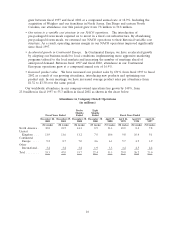

Please find page 27 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Product sales were $237.6 million for the fiscal year ended December 28, 2002, an increase of

$67.2 million, or 39.4%, from $170.4 million for the fiscal year ended December 29, 2001. Product sales

increased 47.4% to $146.8 million domestically and 28.4% to $90.8 million internationally, reflecting

our strategy to focus product sales efforts worldwide on a core group of products that complement our

program. Product sales increased both as a result of attendance growth and higher sales per individual

attendance in all regions.

Franchise royalties were $25.8 million domestically and $5.6 million internationally for the fiscal

year ended December 28, 2002. In total, franchise royalties increased $3.0 million, or 11.0%, from

$28.3 million for the fiscal year ended December 29, 2001, to $31.3 million in fiscal 2002 on the

strength of increased member attendance and product sales. Year-over-year growth in domestic

franchise royalties was reduced as a result of our acquisition of three franchises during fiscal 2002.

Revenues from publications, licensing and other royalties were $20.0 million for the fiscal year

ended December 28, 2002, an increase of $10.5 million, or 110.5%, from $9.5 million for the fiscal year

ended December 29, 2001. This increase was in large part the result of licensing royalty income from

WeightWatchers.com of $4.2 million, which we began accruing in 2002. Other areas of growth included

international licensing revenues and advertising revenues from our publications.

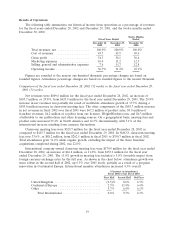

Cost of revenues was $370.3 million for the fiscal year ended December 28, 2002, an increase of

$83.9 million, or 29.3%, from $286.4 million for the fiscal year ended December 29, 2001 in line with

increases in revenues. Gross profit margin was 54.3% of sales in fiscal 2002, a slight increase from the

54.1% level in fiscal 2001.

Marketing expenses increased $11.5 million, or 16.5%, to $81.2 million in the fiscal year ended

December 28, 2002 from $69.7 million in the fiscal year ended December 29, 2001. Marketing expenses

increased to support the continuing growth of the business. As a percentage of net revenues, marketing

expenses decreased from 11.2% in 2001 to 10.0% in 2002, as we continue to leverage our marketing

efforts across the growing revenue base.

Selling, general and administrative expenses were $61.3 million for the fiscal year ended

December 28, 2002, a decrease of $11.7 million, or 16.0%, from $73.0 million for the fiscal year ended

December 29, 2001. As with marketing expenses, selling, general and administrative expenses in 2002

also declined as a percentage of revenues even after the exclusion of two non-recurring expenses which

totaled $16.0 million from the fiscal 2001 amount. In fiscal 2001, the company wrote-off a $6.2 million

uncollectible receivable from a licensing agreement, and, in addition, expensed $9.8 million of goodwill

amortization, a charge which is no longer required since the adoption in 2002 of SFAS Nos. 141 and

142. Excluding these two items from the year-over-year comparison, selling, general and administrative

expenses rose 7.5% in absolute dollars as a result of normal increases for salaries and other expenses,

and declined as a percentage of revenues from 9.1% in fiscal 2001 to 7.6% in fiscal 2002.

Operating income was $296.8 million for the fiscal year ended December 28, 2002, an increase of

$102.0 million, or 52.4%, from $194.8 million for the fiscal year ended December 29, 2001. The

operating income margin in fiscal year 2002 was 36.7%, up from 31.2% in the prior year. Excluding the

two non-recurring selling, general and administrative items mentioned above, last year’s operating

income margin for the fiscal year was 33.8%.

Other expenses, net were $19.0 million for the fiscal year ended December 28, 2002 as compared

to $13.2 million for the fiscal year ended December 29, 2001. In 2002, we recorded unrealized currency

losses on foreign currency denominated debt and other obligations net of hedges of $17.1 million as

compared to unrealized gains of $5.4 million in 2001. Additionally, in 2001 we recorded reserves of

$17.3 million against our loan to WeightWatchers.com.

20