WeightWatchers 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

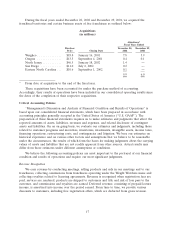

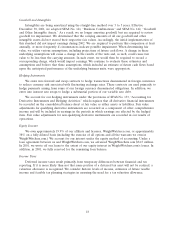

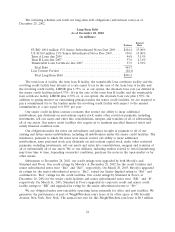

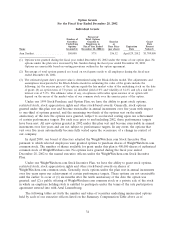

The following schedule sets forth our long-term debt obligations (and interest rates) as of

December 28, 2002.

Long-Term Debt

As of December 28, 2002

(in millions)

Interest

Balance Rate

EURO 100.0 million 13% Senior Subordinated Notes Due 2009 . . . $104.4 13.00%

US $150.0 million 13% Senior Subordinated Notes Due 2009 ..... 150.0 13.00%

Term A Loan due 2005 ................................ 44.8 3.15%

Term B Loan due 2007 ................................ 97.6 4.31%

Transferable Loan Certificate due 2007 ..................... 57.9 4.32%

Total Debt ........................................ 454.7

Less Current Portion .................................. (18.4)

Total Long-Term Debt ................................ $436.3

The term loan A facility, the term loan B facility, the transferable loan certificate facility and the

revolving credit facility bear interest at a rate equal to (a) in the case of the term loan A facility and

the revolving credit facility, LIBOR plus 1.75% or, at our option, the alternate base rate (as defined in

the senior credit facilities) plus 0.75%, (b) in the case of the term loan B facility and the transferable

loan certificate facility, LIBOR plus 2.50% or, at our option, the alternate base rate plus 1.50%. In

addition to paying interest on outstanding principal under the senior credit facilities, we are required to

pay a commitment fee to the lenders under the revolving credit facility with respect to the unused

commitments at a rate equal to 0.50% per year.

Our senior credit facilities contain covenants that restrict our ability to incur additional

indebtedness, pay dividends on and redeem capital stock, make other restricted payments, including

investments, sell our assets and enter into consolidations, mergers and transfers of all or substantially

all of our assets. Our senior credit facilities also require us to maintain specified financial ratios and

satisfy financial condition tests.

Our obligations under the notes are subordinate and junior in right of payment to all of our

existing and future senior indebtedness, including all indebtedness under the senior credit facilities. The

indentures, pursuant to which the notes were issued, restrict our ability to incur additional

indebtedness, issue preferred stock, pay dividends on and redeem capital stock, make other restricted

payments, including investments, sell our assets and enter into consolidations, mergers and transfers of

all or substantially all of our assets. We or our affiliates, including entities related to Artal Luxembourg,

may from time to time, depending on market conditions, purchase the notes in the open market or by

other means.

Subsequent to December 28, 2002, our credit ratings were upgraded by both Moody’s and

Standard and Poors. Our credit ratings by Moody’s at December 28, 2002 for the credit facilities and

senior subordinated notes were ‘‘Ba1’’ and ‘‘Ba3’’, respectively. On March 20, 2003, Moody’s upgraded

its ratings for the senior subordinated notes to ‘‘Ba2’’, raised our Senior Implied rating to ‘‘Ba1’’ and

confirmed its ‘‘Ba1’’ ratings for the credit facilities. Our credit ratings by Standard & Poor’s at

December 28, 2002 for the senior credit facilities and senior subordinated notes were ‘‘BB-’’ and ‘‘B’’,

respectively. On March 11, 2003, Standard & Poor’s upgraded its corporate credit and senior credit

facility ratings to ‘‘BB’’ and upgraded its rating for the senior subordinated notes to ‘‘B+’’.

We are obligated under non-cancelable operating leases primarily for office and rent facilities. We

guarantee the performance of part of WeightWatchers.com’s lease of its office space at 888 Seventh

Avenue, New York, New York. The annual rent rate for this WeightWatchers.com lease is $0.5 million

24