WeightWatchers 2002 Annual Report Download - page 74

Download and view the complete annual report

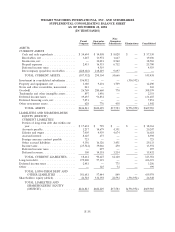

Please find page 74 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

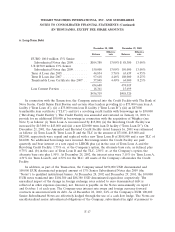

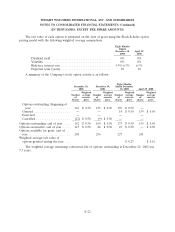

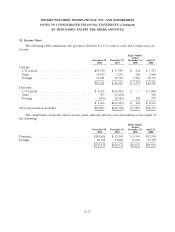

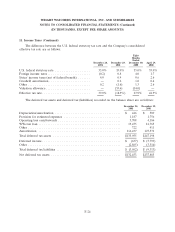

11. Income Taxes (Continued)

On September 29, 1999, the Company effected a recapitalization and stock purchase agreement

with its former parent, Heinz. For U.S. tax purposes, the Transaction was treated as a taxable sale

under IRC section 338(h)(10), resulting in a step-up in the tax basis of net assets and, recognition of a

deferred tax asset in the amount of $144,200. At the time of the Transaction, the Company determined

that it was more likely than not that a portion of the deferred tax asset would not be utilized.

Therefore, a valuation allowance of $72,100 was established against the corresponding deferred tax

asset. Based on the Company’s performance since the Transaction, the Company determined that the

valuation allowance was no longer required. Accordingly, the provision for taxes for the fiscal year

ended December 29, 2001 includes a one-time reversal (credit) of the remaining balance of the

valuation allowance of $71,903 related to the Transaction.

As of December 28, 2002 and December 29, 2001, various foreign subsidiaries of the Company had

net operating loss carry forwards of approximately $12,359 and $13,953, respectively, which can be

carried forward indefinitely.

As of December 29, 2001, the Company’s undistributed earnings of foreign subsidiaries are no

longer considered to be reinvested permanently. The Company will record a deferred tax liability or

asset, if any, based on the expected type of taxable or deductible amounts in future years, taking into

account any related foreign tax credits and withholding taxes. No deferred tax liability or asset was

required to be recorded for undistributed earnings of foreign subsidiaries as of December 28, 2002 and

December 29, 2001.

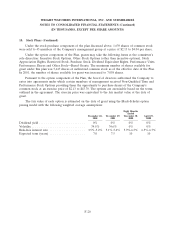

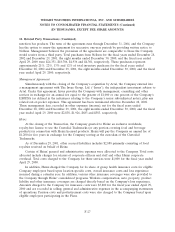

12. Related Party Transactions

WeightWatchers.com:

On September 29, 1999, the Company entered into a subscription agreement with

WeightWatchers.com, Artal and Heinz under which Artal, Heinz and the Company purchased common

stock of WeightWatchers.com for a nominal amount. The Company owns approximately 19.9% of

WeightWatchers.com’s common stock while Artal owns approximately 72.7% of WeightWatchers.com’s

common stock. The Company accounts for its investment in WeightWatchers.com under the equity

method of accounting.

Under the agreement with WeightWatchers.com, the Company granted it an exclusive license to

use its trademarks, copyrights and domain names on the Internet in connection with its online

weight-loss business. The license agreement provides the Company with control of how its intellectual

property is used. In particular, the Company has the right to approve WeightWatchers.com’s

e-commerce activities, strategies and operational plans, marketing programs, privacy policy and

materials publicly displayed on the Internet.

Under warrant agreements dated November 24, 1999, October 1, 2000, May 3, 2001, and

September 10, 2001, the Company has received warrants to purchase an additional 6,395 shares of

WeightWatchers.com’s common stock in connection with the loans that the Company has made to

WeightWatchers.com under the note described below. These warrants will expire from November 24,

2009 to September 10, 2011 and may be exercised at a price of $7.14 per share of

WeightWatchers.com’s common stock until their expiration. The exercise price and the number of

shares of WeightWatchers.com’s common stock available for purchase upon exercise of the warrants

may be adjusted from time to time upon the occurrence of certain events.

F-25