WeightWatchers 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.program innovations. As a percentage of net revenues, marketing expenses decreased from 12.5% for

the twelve months ended December 30, 2000 to 11.2% for the fiscal year ended December 29, 2001.

Selling, general and administrative expenses were $73.0 million for the fiscal year ended

December 29, 2001, an increase of $16.7 million, or 29.7%, from $56.3 million for the twelve months

ended December 30, 2000. As a percentage of net revenues, these costs decreased from 12.8% for the

twelve months ended December 30, 2000 to 11.7% for the fiscal year ended December 29, 2001. The

increase in selling, general and administrative expenses was the result of a one time charge of

$6.2 million for the write-off of a receivable from a licensing agreement, increases in salary and

incentive compensation and goodwill amortization due to the Weighco acquisition. Selling, general and

administrative expenses excluding goodwill amortization of $9.8 million and $6.2 million for the fiscal

year ended December 29, 2001 and the twelve months ended December 30, 2000 were $63.2 million

and $50.1 million, respectively.

As a result of the above, operating income was $194.8 million for the fiscal year ended

December 29, 2001, an increase of $84.5 million, or 76.6%, from $110.3 million for the twelve months

ended December 30, 2000. Pro forma for the acquisition of Weighco, operating income for the twelve

months ended December 30, 2000 was $125.6 million. Pro forma for the acquisition of Weighco,

operating income increased by 55.1% for the fiscal year ended December 29, 2001. Operating income,

excluding goodwill amortization of $9.8 million and $6.2 million for the fiscal year ended December 29,

2001 and the twelve months ended December 30, 2000, was $204.6 million and $116.5 million,

respectively.

Other expenses, net were $13.2 million for the fiscal year ended December 29, 2001, an increase of

$9.7 million, or 277.1%, from $3.5 million for the twelve months ended December 30, 2000. This

increase was primarily due to changes in unrealized currency gains and losses and advances to

WeightWatchers.com.

Provision for (benefit from) income taxes was ($23.2) million for the fiscal year ended

December 29, 2001, a decrease of $41.3 million, or 228.2%, from $18.1 million for the twelve months

ended December 30, 2000. The decrease was due to a one-time benefit of $71.9 million for the reversal

of the remaining valuation allowance set up in conjunction with the Transaction. At the time of the

Transaction, we determined that it was more likely than not that a portion of the deferred tax asset

would not be utilized. Therefore, a valuation allowance of approximately $72.1 million was established

against the corresponding deferred tax asset. Based on our performance since the Transaction, we

determined that the valuation allowance is no longer required.

An extraordinary charge on the early extinguishment of debt, net of taxes, was $2.9 million for the

fiscal year ended December 29, 2001. The one-time charge of $2.9 million related to the refinancing of

the term loan B facility, term loan D facility and the transferable loan certificate. Our term loan B

facility, term loan D facility and the transferable loan certificate were repaid in the amount of $71.0,

$19.0 and $82.0 million, respectively, and replaced with a new term loan B facility of $108.0 million and

a new transferable loan certificate of $64.0 million.

Liquidity and Capital Resources

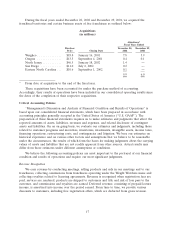

For the fiscal year ended December 28, 2002, cash and cash equivalents increased $34.2 million to

$57.5 million and cash flows provided by operating activities were $164.9 million. Funds were used

primarily for investing and financing activities. Investing activities in the year totaled $73.9 million and

were primarily attributable to $68.1 million paid in connection with the acquisition of the assets of our

North Jersey, San Diego and Eastern North Carolina franchises, and $4.9 million invested in capital

expenditures. Cash used for financing activities totaled $60.5 million, including borrowings of

$58.5 million which were subsequently repaid as part of the $93.8 million paid in on our senior credit

facilities, the repurchase of all $25.0 million of our outstanding preferred stock and the $1.2 million

cumulative final dividend payment on our preferred stock.

22