WeightWatchers 2002 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

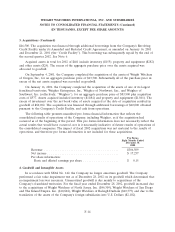

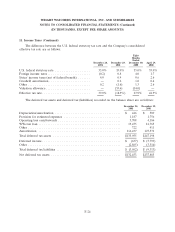

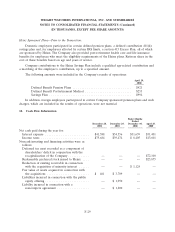

11. Income Taxes (Continued)

The difference between the U.S. federal statutory tax rate and the Company’s consolidated

effective tax rate are as follows:

Eight

Months

Ended

December 28, December 29, December 30, April 29,

2002 2001 2000 2000

U.S. federal statutory rate .................... 35.0% 35.0% 35.0% 35.0%

Foreign income taxes ........................ (0.2) 0.8 4.0 1.7

States’ income taxes (net of federal benefit) ....... 4.0 0.9 0.6 2.6

Goodwill amortization ....................... — 0.2 1.0 0.4

Other................................... 0.2 (1.6) 1.3 2.6

Valuation allowance ......................... —(53.6) (14.0) —

Effective tax rate........................... 39.0% (18.3%) 27.9% 42.3%

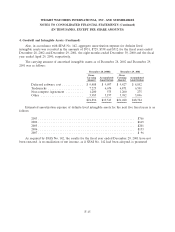

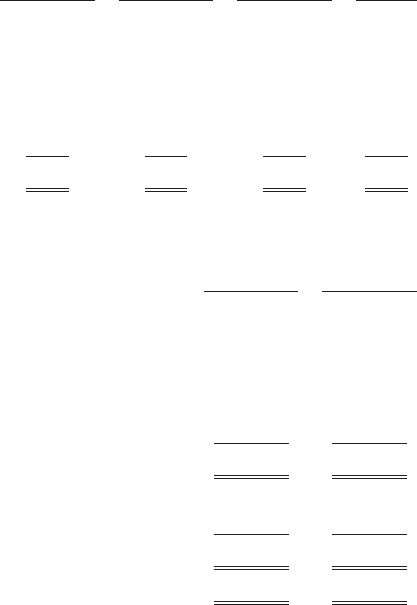

The deferred tax assets and deferred tax (liabilities) recorded on the balance sheet are as follows:

December 28, December 29,

2002 2001

Depreciation/amortization ..................................... $ 446 $ 509

Provision for estimated expenses ................................ 1,187 1,756

Operating loss carryforwards ................................... 3,708 4,186

WW.com loan .............................................. 13,455 12,765

Other.................................................... 722 411

Amortization .............................................. 116,437 127,571

Total deferred tax assets ...................................... $135,955 $147,198

Deferred income ............................................ $ (637) $ (5,799)

Other.................................................... (2,865) (3,514)

Total deferred tax liabilities .................................... $ (3,502) $ (9,313)

Net deferred tax assets ....................................... $132,453 $137,885

F-24