WeightWatchers 2002 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

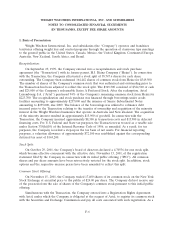

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

2. Summary of Significant Accounting Policies (Continued)

Company will apply the recognition provisions of Interpretation No. 45 prospectively to guarantee

activities initiated after December 31, 2002. Refer to Note 12 on discussion of WeightWatchers.com

lease guarantee.

The FASB recently issued Interpretation No. 46, ‘‘Consolidation of Variable Interest Entities.’’

Interpretation No. 46 requires that the assets, liabilities and results of the activity of variable interest

entities be consolidated into the financial statements of the company that has the controlling financial

interest. Interpretation No. 46 also provides the framework for determining whether a variable interest

entity should be consolidated based on voting interest or significant financial support provided to it.

Interpretation No. 46 is effective for the Company on February 1, 2003 for variable interest entities

created after January 31, 2003, and on June 29, 2003 for variable interest entities created prior to

February 1, 2003. The Company is currently reviewing Interpretation No. 46 to determine its impact, if

any, on the Company’s consolidated financial position, results of operations, or cash flows.

Reclassification:

Certain prior year amounts have been reclassified to conform to the current year presentation.

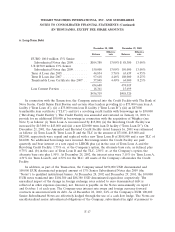

3. Acquisitions

During fiscal 2002 and 2001, the Company acquired the assets of five of its franchises as outlined

below.

These acquisitions have been accounted for under the purchase method of accounting and,

accordingly, earnings have been included in the consolidated operating results of the Company since

the date of acquisition.

On September 1, 2002, the Company completed the acquisition of the assets of one of its

franchisees, AZIS Properties of Raleigh Durham, Inc. (d/b/a Weight Watchers of Raleigh Durham),

pursuant to the terms of an Asset Purchase Agreement among Weight Watchers of Raleigh Durham,

the Company and Weight Watchers North America, Inc., a wholly owned subsidiary of the Company.

Substantially all of the purchase price in excess of the net assets acquired has been recorded as

goodwill. The purchase price for the acquisition was $10,600 and was financed through cash from

operations.

On July 2, 2002, the Company completed the acquisition of the assets of one of its franchisees,

Weight Watchers of San Diego and The Inland Empire, Inc., pursuant to the terms of an Asset

Purchase Agreement among Weight Watchers of San Diego, the Company and Weight Watchers North

America, Inc. Substantially all of the purchase price in excess of the net assets acquired has been

recorded as goodwill. The purchase price for the acquisition was $11,000 and was financed through

cash from operations.

On January 18, 2002, the Company completed the acquisition of the assets of one of its

franchisees, Weight Watchers of North Jersey, Inc., pursuant to the terms of an Asset Purchase

Agreement executed on December 31, 2001 among Weight Watchers of North Jersey, Inc., the

Company and Weight Watchers North America, Inc. Substantially all of the purchase price in excess of

the net assets acquired has been recorded as goodwill. The purchase price for the acquisition was

F-13