WeightWatchers 2002 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

We are the leading provider of weight-loss services, operating in 30 countries around the world.

We conduct our business through a combination of company-owned and franchise operations, with

company-owned operations accounting for 67% of total worldwide attendance for the fiscal year ended

December 28, 2002 of which 67% of our revenues were derived from our U.S. operations, and the

remaining 33% of our revenues result from our international operations. We derive our revenues

principally from:

•Meeting fees. Our members pay us a weekly fee to attend our classes.

•Product sales. We sell proprietary products that complement our program, such as snack bars,

books, CD-ROMs and POINTS calculators, to our members and franchisees.

•Franchise royalties. Our franchisees typically pay us a royalty fee of 10% of their meeting fee

revenues.

•Other. We license our brand for certain foods, books and other products. We also generate

revenues from the publishing of books and magazines and third-party advertising.

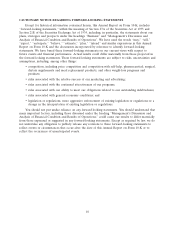

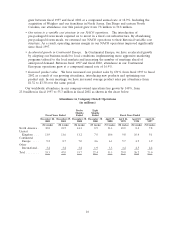

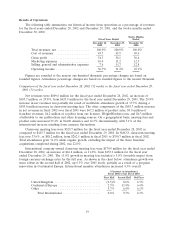

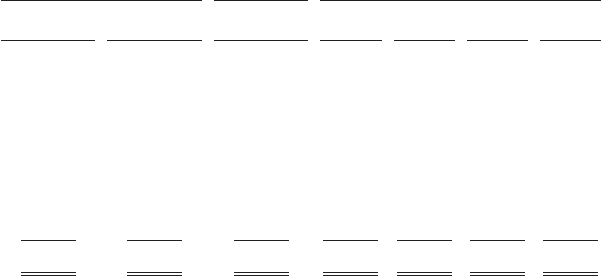

The following table sets forth our revenues by category for the 2002 and 2001 fiscal years, the

eight months ended December 30, 2000, and the 2000, 1999, 1998 and 1997 fiscal years.

Revenue Sources

(in millions)

Eight

Months

Fiscal Years Ended Ended Fiscal Years Ended

December 28, December 29, December 30, April 29, April 24, April 25, April 26,

2002 2001 2000 2000 1999 1998 1997

NACO meetings fees ......... $350.7 $262.5 $ 96.8 $130.8 $122.3 $ 93.8 $ 86.5

International company-owned

meeting fees.............. 170.0 153.2 87.3 152.7 143.9 129.0 113.6

Product sales ............... 237.6 170.4 66.4 84.2 57.3 46.7 30.8

Franchise royalties ........... 31.3 28.3 17.7 25.8 23.2 17.9 13.9

Other..................... 20.0 9.5 5.0 6.0 17.9 9.0 14.0

Pre-packaged meals

(Discontinued) ............ —————0.80 34.0

Total ..................... $809.6 $623.9 $273.2 $399.5 $364.6 $297.2 $292.8

In fiscal 1997, we made the strategic decision to discontinue the sale of pre-packaged frozen meals

in our NACO classroom meetings (which were added in 1990 by our former owner, Heinz) and to

introduce to our NACO operations some of the best practices developed by our European managers.

After our acquisition by Artal Luxembourg in 1999, we reorganized our management and strengthened

our strategic focus. Since 1997, our revenues have increased as shown in the chart above. Our

operating income margin has grown from 6.7% (before a restructuring charge) in fiscal 1997 to 36.7%

in fiscal 2002. The increases are principally a result of:

•Increased NACO classroom attendance. As a result of our decision to re-focus our meetings

exclusively on our group education approach and the introduction of our POINTS-based

program developed in the United Kingdom and our Liberty/Loyalty meeting fee pricing strategy

developed in France, our NACO classroom attendance, excluding the impact of our acquisitions,

15