WeightWatchers 2002 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

plus increases for operating expenses and real estate taxes. This lease expires in September 2003. Rent

expense charged to operations under all our leases for the fiscal year ended December 28, 2002 was

approximately $16.3 million.

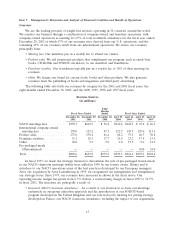

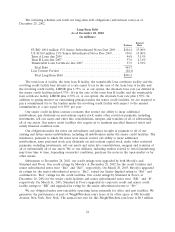

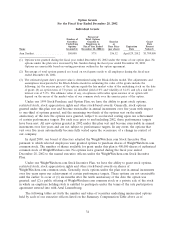

The following schedule sets forth our year-by-year long-term obligations as of December 28, 2002.

Long-Term Obligations

As of December 28, 2002

(in millions)

Debt

(including

Payments Due current Lease

by Fiscal Year portion) Commitments Total

2003 ................................... $18.4 $15.7 $ 34.1

2004 ................................... 16.0 11.9 27.9

2005 ................................... 15.5 8.2 23.7

2006 ................................... 1.6 5.2 6.8

2007 ................................... 148.8 3.6 152.4

Thereafter .............................. 254.4 15.9 270.3

Total................................. $454.7 $60.5 $515.2

Debt obligations due to be repaid in the twelve months following December 28, 2002 are expected

to be satisfied with operating cash flows. We believe that cash flows from operating activities, together

with borrowings available under our revolving credit facility, will be sufficient for the next twelve

months to fund currently anticipated capital expenditure requirements, debt service requirements and

working capital requirements.

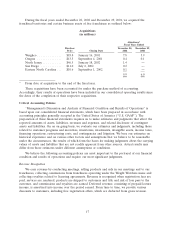

On January 18, 2002, we completed the acquisition of our North Jersey franchise for a purchase

price of $46.5 million. The acquisition was financed through additional borrowings from our senior

credit facilities, which were subsequently repaid by the end of the second quarter of 2002.

On July 2, 2002, we completed the acquisition of our San Diego franchise for a purchase price of

$11.0 million. The acquisition was financed through cash from operations.

On September 1, 2002, we completed the acquisition of our eastern North Carolina franchise for a

purchase price of $10.6 million. The acquisition was financed through cash from operations.

As of December 29, 2001, we had one million shares of Series A Preferred Stock issued and

outstanding with a preference value of $25.0 million. Holders of the Series A Preferred Stock were

entitled to receive dividends at an annual rate of 6% payable annually in arrears. On March 1, 2002,

we redeemed all of our Series A Preferred Stock held by Heinz for a redemption price of $25.0 million

plus accrued and unpaid dividends. The redemption was financed through additional borrowings of

$12.0 million under the revolving credit facility and cash from operations.

Any future acquisitions, joint ventures or other similar transactions could require additional capital

and we cannot be certain that any additional capital will be available on acceptable terms or at all. Our

ability to fund our capital expenditure requirements, interest, principal and dividend payment

obligations and working capital requirements and to comply with all of the financial covenants under

our debt agreements depends on our future operations, performance and cash flow. These are subject

to prevailing economic conditions and to financial, business and other factors, some of which are

beyond our control.

Off-Balance Sheet Transactions

As part of our on-going business, we do not participate in transactions that generate relationships

with unconsolidated entities or financial partnerships established for the purpose of facilitating

25