WeightWatchers 2002 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Comparison of the fiscal year ended December 29, 2001 (52 weeks) to the twelve months ended

December 30, 2000 (54 weeks).

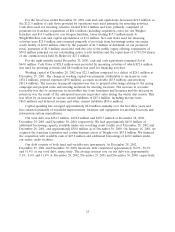

Net revenues were $623.9 million for the fiscal year ended December 29, 2001, an increase of

$184.5 million, or 42.0%, from $439.4 million for the twelve months ended December 30, 2000. Of the

$184.5 million increase, $112.2 million was attributable to NACO classroom meeting fees, $11.3 million

from international company-owned classroom meeting fees, $58.1 million from product sales and

$2.9 million from licensing, publications and other royalties. Pro forma for the acquisition of Weighco,

net revenues for the twelve months ended December 30, 2000 were $488.2 million. The pro forma

financial information assumes the acquisition of Weighco occurred at the beginning of the earliest

period presented.

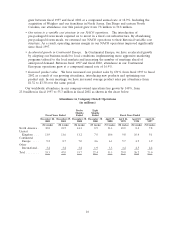

NACO classroom meeting fees were $262.5 million for the fiscal year ended December 29, 2001,

an increase of $112.2 million, or 74.7%, from $150.3 million for the twelve months ended December 30,

2000. International company-owned classroom meeting fees were $153.2 million for the fiscal year

ended December 29, 2001, an increase of $11.3 million, or 8.0%, from $141.9 million for the twelve

months ended December 29, 2000. NACO meeting fees benefited from the inclusion of Weighco in the

current fiscal year. Additionally, the increases in NACO and international company-owned meeting fees

were the result of increased member attendance and the roll-out of new program innovations and price

increases in select markets, offset in part by negative exchange rate variances.

Product sales were $170.4 million for the fiscal year ended December 29, 2001, an increase of

$58.1 million, or 51.7%, from $112.3 million for the twelve months ended December 30, 2000. NACO

and international company-owned product sales were $99.7 million and $70.7 million, respectively. The

increases in product sales were primarily the result of increased member attendance and our strategy to

focus sales efforts on core classroom products, which has increased average product sales per

attendance.

Franchise royalties were $28.3 million for the fiscal year ended December 29, 2001, and for the

twelve months ended December 30, 2000. For the fiscal year ended December 29, 2001, domestic and

international franchise royalties were $23.3 million and $5.0 million, respectively. Pro forma for the

acquisition of Weighco, franchise royalties increased 24.4% for the fiscal year ended December 29,

2001. This increase was primarily the result of increased member attendance, offset in part by negative

exchange rate variances.

Royalties from licensing, publications and other were $9.5 million for the fiscal year ended

December 29, 2001, an increase of $2.9 million, or 43.9%, from $6.6 million for the twelve months

ended December 30, 2000. This increase was driven by an increase in advertising revenue from Weight

Watchers Magazine and an increase in licensing royalties.

Cost of revenues was $286.4 million for the fiscal year ended December 29, 2001, an increase of

$68.4 million, or 31.4%, from $218.0 million for the twelve months ended December 30, 2000. Gross

profit margin was 54.1% for the fiscal year ended December 29, 2001, compared to 50.4% for the

twelve months ended December 30, 2000. Typically, the gross profit margin for meeting fee revenue is

slightly higher than the gross profit margin for product sales. The increase in gross profit margin was

partly due to a $3.8 million non-recurring expense related to the elimination of a profit sharing

agreement with certain franchisees in the twelve months ended December 30, 2000. Excluding this

charge, the gross profit margin in the twelve months ended December 30, 2000 was 51.3%. The

remaining increase in gross profit margin reflects increased attendance, price increases and cost control

initiatives.

Marketing expenses were $69.7 million for the fiscal year ended December 29, 2001, an increase of

$14.9 million, or 27.2%, from $54.8 million for the twelve months ended December 30, 2000. The

increase in marketing expenses was primarily the result of additional advertising to promote the new

21