WeightWatchers 2002 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

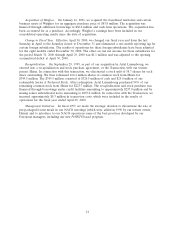

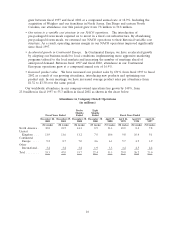

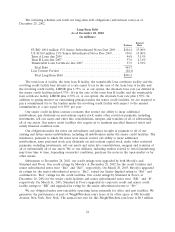

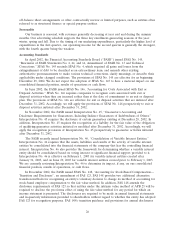

During the fiscal years ended December 28, 2002 and December 29, 2001, we acquired the

franchised territories and certain business assets of five franchisees as outlined below:

Acquisitions

(in millions)

Attendance*

Fiscal Years Ended

Purchase December 28, December 29,

Price Closing Date 2002 2001

Weighco .............. $83.8 January 16, 2001 7.8 5.9

Oregon .............. $13.5 September 4, 2001 0.4 0.1

North Jersey........... $46.5 January 18, 2002 1.4 —

San Diego ............ $11.0 July 2, 2002 0.2 —

Eastern North Carolina . . . $10.6 September 1, 2002 0.1 —

9.9 6.0

* From date of acquisition to the end of the fiscal year.

These acquisitions have been accounted for under the purchase method of accounting.

Accordingly, their results of operations have been included in our consolidated operating results since

the dates of the completion of their respective acquisitions.

Critical Accounting Policies

‘‘Management’s Discussion and Analysis of Financial Condition and Results of Operations’’ is

based upon our consolidated financial statements, which have been prepared in accordance with

accounting principles generally accepted in the United States of America (‘‘U.S. GAAP’’). The

preparation of these financial statements requires us to make estimates and judgments that affect the

reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent

assets and liabilities. On an on going basis, we evaluate our estimates and judgments, including those

related to customer programs and incentives, inventories, investments, intangible assets, income taxes,

financing operations, restructuring costs, and contingencies and litigation. We base our estimates on

historical experience and on various other factors and assumptions that we believe to be reasonable

under the circumstances, the results of which form the bases for making judgments about the carrying

values of assets and liabilities that are not readily apparent from other sources. Actual results may

differ from these estimates under different assumptions or conditions.

We believe the following accounting policies are most important to the portrayal of our financial

condition and results of operations and require our most significant judgments.

Revenue Recognition

We earn revenue by conducting meetings, selling products and aids in our meetings and to our

franchisees, collecting commissions from franchisees operating under the Weight Watchers name and

collecting royalties related to licensing agreements. Revenue is recognized when registration fees are

paid, services are rendered, products are shipped to customers and title and risk of loss pass to the

customer, and commissions and royalties are earned. Deferred revenue, consisting of prepaid lecture

income, is amortized into income over the period earned. From time to time, we provide various

discounts to customers, including free registration offers, which are deducted from gross revenue.

17