WeightWatchers 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

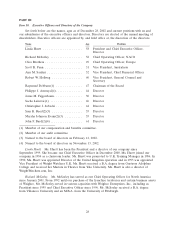

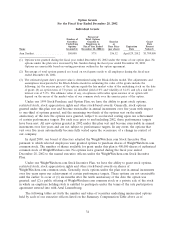

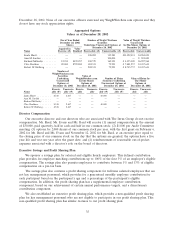

Option Grants

For the Fiscal Year Ended December 28, 2002

Individual Grants

Percent of

Number of Total Options

Securities Granted to Exercise Grant

Underlying Employees in or Date

Options Fiscal Year Ended Base Price Expiration Present

Name Granted(1) December 28, 2002(2) (per share) Date Value(3)

Ann Sardini ................. 100,000 57% $36.32 April 29, 2012 $1,709,000

(1) Options were granted during the fiscal year ended December 28, 2002 under the terms of our option plan. No

options under the plan were exercised by Ms. Sardini during the fiscal year ended December 28, 2002.

Options are exercisable based on vesting provisions outlined in the option agreement.

(2) Percentage of total options granted are based on total grants made to all employees during the fiscal year

ended December 28, 2002.

(3) The estimated grant date’s present value is determined using the Black-Scholes model. The adjustments and

assumptions incorporated in the Black-Scholes model in estimating the value of the grants include the

following: (a) the exercise price of the options equals the fair market value of the underlying stock on the date

of grant; (b) an option term of 7.0 years; (c) dividend yield of 0% and volatility of 34.4% and (d) a risk free

interest rate of 5.2%. The ultimate value, if any, an optionee will realize upon exercise of an option will

depend on the excess of the market value of our common stock over the exercise price of the option.

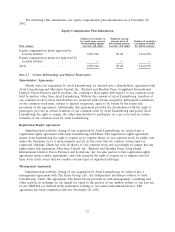

Under our 1999 Stock Purchase and Option Plan, we have the ability to grant stock options,

restricted stock, stock appreciation rights and other stock-based awards. Generally, stock options

granted under this plan vest and become exercisable in annual increments over five years with respect

to one-third of options granted, and the remaining two-thirds of the options vest on the ninth

anniversary of the date the options were granted, subject to accelerated vesting upon our achievement

of certain performance targets. For each year prior to and including 2002, these performance targets

have been met. All new options granted in 2002 under this plan vest and become exercisable in annual

increments over five years and are not subject to performance targets. In any event, the options that

vest over five years automatically become fully vested upon the occurrence of a change in control of

our company.

In April 2000, our board of directors adopted the WeightWatchers.com Stock Incentive Plan

pursuant to which selected employees were granted options to purchase shares of WeightWatchers.com

common stock. The number of shares available for grant under this plan is 400,000 shares of authorized

common stock of WeightWatchers.com. No options were granted during the fiscal year ended

December 28, 2002 to the named executive officers under the WeightWatchers.com Stock Incentive

Plan.

Under our WeightWatchers.com Stock Incentive Plan, we have the ability to grant stock options,

restricted stock, stock appreciation rights and other stock-based awards on shares of

WeightWatchers.com common stock. Generally, stock options under the plan vest in annual increments

over five years upon our achievement of certain performance targets. These options are not exercisable

until the earlier to occur of (1) six months after the tenth anniversary of the date the option was

granted; and (2) a public offering of WeightWatchers.com common stock or a private sale of the stock

in which an employee holding stock is entitled to participate under the terms of the sale participation

agreement entered into with Artal Luxembourg.

The following tables set forth the number and value of securities underlying unexercised options

held by each of our executive officers listed on the Summary Compensation Table above as of

34