WeightWatchers 2002 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

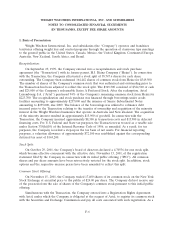

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

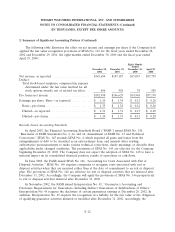

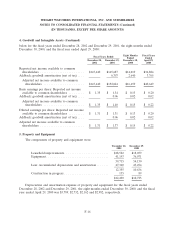

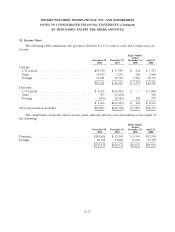

4. Goodwill and Intangible Assets (Continued)

below for the fiscal years ended December 28, 2002 and December 29, 2001, the eight months ended

December 30, 2000, and the fiscal year ended April 29, 2000:

Eight Months Fiscal Years

Fiscal Years Ended Ended Ended

December 28, December 29, December 30, April 29,

2002 2001 2000 2000

Reported net income available to common

shareholders ......................... $143,440 $145,687 $14,019 $36,884

Addback: goodwill amortization (net of tax) . . . . 6,357 2,640 3,765

Adjusted net income available to common

shareholders ....................... $143,440 $152,044 $16,659 $40,649

Basic earnings per share: Reported net income

available to common shareholders ......... $ 1.35 $ 1.34 $ 0.13 $ 0.20

Addback: goodwill amortization (net of tax) . . . . 0.06 0.02 0.02

Adjusted net income available to common

shareholders ....................... $ 1.35 $ 1.40 $ 0.15 $ 0.22

Diluted earnings per share: Reported net income

available to common shareholders ......... $ 1.31 $ 1.31 $ 0.13 $ 0.20

Addback: goodwill amortization (net of tax) . . . . 0.06 0.02 0.02

Adjusted net income available to common

shareholders ......................... $ 1.31 $ 1.37 $ 0.15 $ 0.22

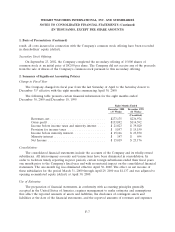

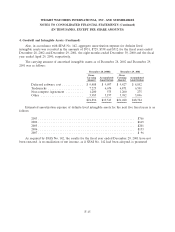

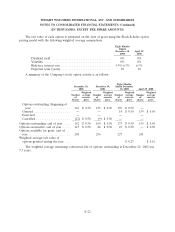

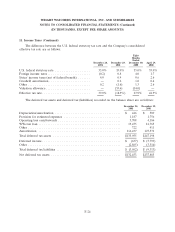

5. Property and Equipment

The components of property and equipment were:

December 28, December 29,

2002 2001

Leasehold improvements ......................... $18,522 $18,059

Equipment ................................... 41,193 36,071

59,715 54,130

Less: Accumulated depreciation and amortization ....... 47,360 43,494

12,355 10,636

Construction in progress......................... 135 89

$12,490 $10,725

Depreciation and amortization expense of property and equipment for the fiscal years ended

December 28, 2002 and December 29, 2001, the eight months ended December 30, 2000, and the fiscal

year ended April 29, 2000 was $3,789, $2,732, $2,162 and $2,982, respectively.

F-16