WeightWatchers 2002 Annual Report Download - page 58

Download and view the complete annual report

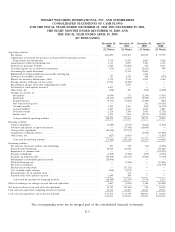

Please find page 58 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

2. Summary of Significant Accounting Policies (Continued)

No. 144 provides updated guidance concerning the recognition and measurement of an impairment loss

for certain types of long-lived assets, expands the scope of a discontinued operation to include a

component of an entity and eliminates the exemption to consolidate when control over a subsidiary is

likely to be temporary. The adoption of this new standard did not have a material impact on the

consolidated financial position, results of operations or cash flows of the Company.

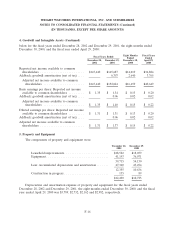

Intangibles:

Effective December 30, 2001, the Company adopted SFAS No. 141, ‘‘Business Combinations’’ and

SFAS No. 142, ‘‘Goodwill and Other Intangible Assets.’’ As a result, the Company is no longer

required to amortize indefinite life goodwill and intangible assets as a charge to earnings but is

required to conduct an annual review of goodwill and other intangible assets for potential impairment.

Prior to fiscal 2002, goodwill, trademarks and other intangibles arising from acquisitions, including

the acquisition of previously franchised areas, were being amortized on a straight-line basis over periods

ranging from 3 to 40 years. Amortization of goodwill, trademarks and other intangibles for the fiscal

year ended December 29, 2001, the eight months ended December 30, 2000, and the fiscal year ended

April 29, 2000 was $10,511, $4,515 and $6,304, respectively. Amortization of definite lived trademarks

and other intangibles for the fiscal year ended December 28, 2002 was $951. See Note 4.

The Company accounts for software costs under the AICPA Statement of Position (‘‘SOP’’)

No. 98-1, ‘‘Accounting for the Costs of Computer Software Developed or Obtained for Internal Use’’.

SOP No. 98-1 requires capitalization of certain costs incurred in connection with developing or

obtaining internally used software. Software costs are amortized over 3 to 5 years.

Revenue Recognition:

The Company earns revenue by conducting meetings, selling products and aids in its meetings and

to its franchisees, collecting commissions from franchisees operating under the Weight Watchers name

and collecting royalties related to licensing agreements. Revenue is recognized when registration fees

are paid, services are rendered, products are shipped to customers and title and risk of loss pass to the

customer, and commissions and royalties are earned. Deferred revenue, consisting of prepaid lecture

income, is amortized into income over the period earned. From time to time, the Company provides

various discounts to customers, including free registration offers, which are deducted from gross

revenue.

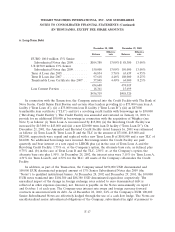

Advertising Costs:

Advertising costs consist primarily of national and local direct mail, television, and spokesperson’s

fees. All costs related to advertising are expensed in the period incurred, except for TV and radio

media related costs which are expensed the first time the advertising takes place. Total advertising

expenses for the fiscal years ended December 28, 2002 and December 29, 2001, the eight months ended

December 30, 2000, and the fiscal year ended April 29, 2000 were $78,293, $66,749, $25,792 and

$48,027, respectively.

F-9