WeightWatchers 2002 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for Registrant’s Common Stock and Related Shareholder Matters

Weight Watchers common stock is listed on the New York Stock Exchange (the ‘‘NYSE’’). The

common stock was first traded on the NYSE on November 15, 2001 under the symbol ‘‘WTW’’,

concurrent with the underwritten initial public offering of 17,400,000 shares of our common stock at an

initial price to the public of $24.00 per share. The underwriters exercised their option to purchase

2,610,000 additional shares of our common stock to cover over-allotments. We did not receive any of

the proceeds from the sale of shares of our common stock pursuant to this initial public offering. Prior

to this offering, there was no established public trading market for our common stock.

On September 23, 2002, Artal Luxembourg completed a secondary offering of 15,000,000 shares of

common stock at a price of $42.00 per share. The underwriters exercised their option to purchase

2,250,000 additional shares of our common stock to cover over-allotments. We did not receive any of

the proceeds from the sale of shares of our common stock pursuant to this secondary offering.

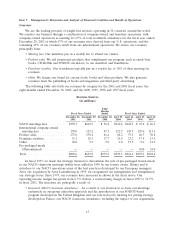

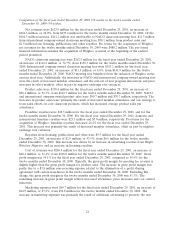

The following table sets forth, for the period indicated, the high and low sales prices per share for

our common stock as reported on the New York Stock Exchange consolidated tape (NYSE ticker

symbol: ‘‘WTW’’).

Fiscal Year ended December 29, 2001 High Low

Fourth Quarter ...................................... $36.01 $28.25

Fiscal Year ended December 28, 2002 High Low

First Quarter ........................................ $39.35 $31.35

Second Quarter ...................................... $44.55 $35.80

Third Quarter....................................... $48.67 $35.10

Fourth Quarter ...................................... $50.39 $42.24

Holders

The approximate number of holders of record of common stock as of January 31, 2003 was 116.

This number does not include beneficial owners of our securities held in the name of nominees.

Dividends

No cash dividends were declared or paid on our common stock in 2002. We currently intend to

retain all available funds for use in our business, and do not anticipate paying cash dividends in the

foreseeable future. In addition, our existing debt instruments place limitations on our ability to pay

dividends. Any future determination as to the payment of dividends will be subject to such limitations,

will be at the discretion of our board of directors and will depend on our results of operations,

financial condition, capital requirements and other factors deemed relevant by our board of directors.

12