WeightWatchers 2002 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

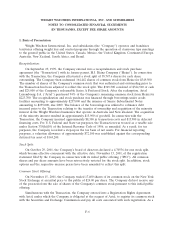

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

3. Acquisitions (Continued)

$46,500. The acquisition was financed through additional borrowings from the Company’s Revolving

Credit Facility under its Amended and Restated Credit Agreement, as amended on January 16, 2001

and December 21, 2001 (the ‘‘Credit Facility’’). This borrowing was subsequently repaid by the end of

the second quarter 2002. See Note 6.

Acquired assets in total for 2002 of $461 include inventory ($155), property and equipment ($282)

and other assets ($24). The excess of the aggregate purchase price over the assets acquired was

allocated to goodwill.

On September 4, 2001, the Company completed the acquisition of the assets of Weight Watchers

of Oregon, Inc., for an aggregate purchase price of $13,500. Substantially all of the purchase price in

excess of the net assets acquired was recorded as goodwill.

On January 16, 2001, the Company completed the acquisition of the assets of one of its largest

franchised territories, Weighco Enterprises, Inc., Weighco of Northwest, Inc., and Weighco of

Southwest, Inc. (collectively, ‘‘Weighco’’), for an aggregate purchase price of $83,800 plus acquisition

costs of $577. Assets acquired included inventory ($1,884) and property and equipment ($1,801). The

excess of investment over the net book value of assets acquired at the date of acquisition resulted in

goodwill of $80,692. The acquisition was financed through additional borrowings of $60,000 obtained

pursuant to the Company’s Credit Facility, and cash from operations.

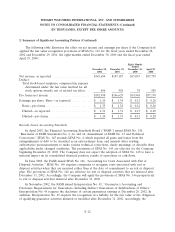

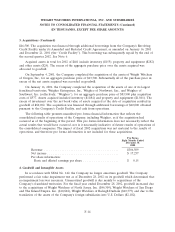

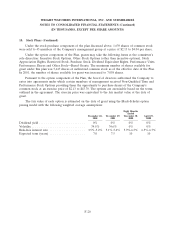

The following table presents unaudited pro forma financial information that reflects the

consolidated results of operations of the Company, including Weighco, as if the acquisition had

occurred as of the beginning of the period. This pro forma information does not necessarily reflect the

actual results that would have occurred, nor is it necessarily indicative of future results of operations of

the consolidated companies. The impact of fiscal 2002 acquisitions was not material to the results of

operations, and therefore pro forma information is not included for these acquisitions.

Pro Forma

Eight Months Ended

December 30,

2000

Revenue .......................................... $306,509

Net income ........................................ $ 17,257

Per share information:

Basic and diluted earnings per share .................... $ 0.15

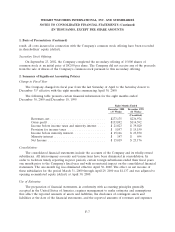

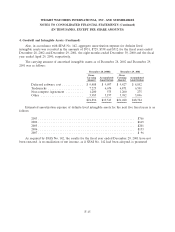

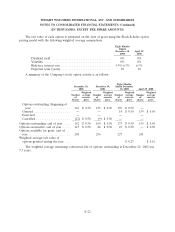

4. Goodwill and Intangible Assets

In accordance with SFAS No. 142, the Company no longer amortizes goodwill. The Company

performed a fair value impairment test as of December 28, 2002 on its goodwill which determined that

no impairment loss was necessary. Unamortized goodwill is due mainly to acquisitions of the

Company’s franchised territories. For the fiscal year ended December 28, 2002, goodwill increased due

to the acquisitions of Weight Watchers of North Jersey, Inc. ($46,309), Weight Watchers of San Diego

and The Inland Empire, Inc. ($10,804), Weight Watchers of Raleigh Durham ($10,575) and due to the

translation of the assets of the Company’s foreign subsidiaries into U.S. Dollars ($2,102).

F-14