WeightWatchers 2002 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

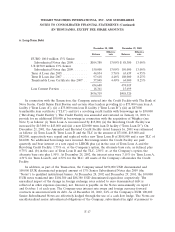

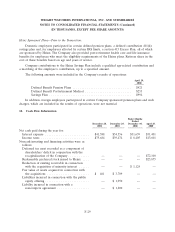

10. Stock Plans (Continued)

Under the stock purchase component of the plan discussed above, 1,639 shares of common stock

were sold to 45 members of the Company’s management group at a price of $2.13 to $4.04 per share.

Under the option component of the Plan, grants may take the following forms at the committee’s

sole discretion: Incentive Stock Options, Other Stock Options (other than incentive options), Stock

Appreciation Rights, Restricted Stock, Purchase Stock, Dividend Equivalent Rights, Performance Units,

Performance Shares and Other Stock—Based Grants. The maximum number of shares available for

grant under this plan was 5,647 shares of authorized common stock as of the effective date of the Plan.

In 2001, the number of shares available for grant was increased to 7,058 shares.

Pursuant to the option component of the Plan, the board of directors authorized the Company to

enter into agreements under which certain members of management received Non-Qualified Time and

Performance Stock Options providing them the opportunity to purchase shares of the Company’s

common stock at an exercise price of $2.13 to $43.70. The options are exercisable based on the terms

outlined in the agreement. The exercise price was equivalent to the fair market value at the date of

grant.

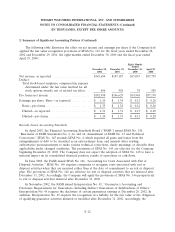

The fair value of each option is estimated on the date of grant using the Black-Scholes option

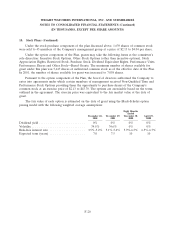

pricing model with the following weighted average assumptions:

Eight Months

Ended

December 28, December 29, December 30, April 29,

2002 2001 2000 2000

Dividend yield .......................... 0% 0% 0% 0%

Volatility .............................. 34.5% 34.6% 0% 0%

Risk-free interest rate .................... 3.5%-5.2% 5.1%-5.4% 5.9%-6.3% 6.5%-6.7%

Expected term (years) .................... 7.0 7.5 10 10

F-20