WeightWatchers 2002 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2002 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

1. Basis of Presentation (Continued)

result, all costs incurred in connection with the Company’s common stock offering have been recorded

in shareholders’ equity (deficit).

Secondary Stock Offering:

On September 23, 2002, the Company completed the secondary offering of 15,000 shares of

common stock at an initial price of $42.00 per share. The Company did not receive any of the proceeds

from the sale of shares of the Company’s common stock pursuant to this secondary offering.

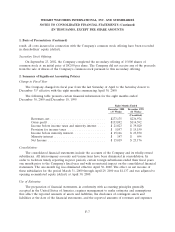

2. Summary of Significant Accounting Policies

Change in Fiscal Year:

The Company changed its fiscal year from the last Saturday of April to the Saturday closest to

December 31st effective with the eight months commencing April 30, 2000.

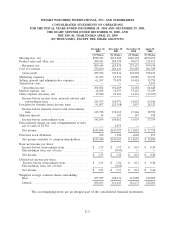

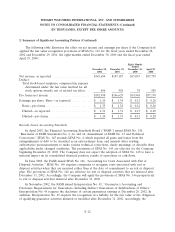

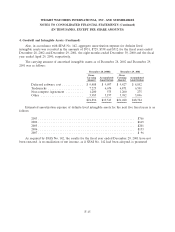

The following table presents certain financial information for the eight months ended

December 30, 2000 and December 18, 1999.

Eight Months Ended

December 2000 December 1999

(35 Weeks) (34 Weeks)

(Unaudited)

Revenues, net ............................... $273,175 $236,974

Gross profit................................ $133,892 $114,592

Income before income taxes and minority interest . . . . $ 21,023 $ 39,020

Provision for income taxes ..................... $ 5,857 $15,150

Income before minority interest .................. $ 15,166 $ 23,870

Minority interest ............................. $ 147 $ 694

Net Income ................................ $15,019 $23,176

Consolidation:

The consolidated financial statements include the accounts of the Company and its wholly-owned

subsidiaries. All intercompany accounts and transactions have been eliminated in consolidation. In

order to facilitate timely reporting in prior periods, certain foreign subsidiaries ended their fiscal years

one month prior to the Company’s fiscal year end with no material impact on the consolidated financial

statements. The one-month lag was eliminated effective April 30, 2000. The effect on net income of

these subsidiaries for the period March 31, 2000 through April 29, 2000 was $1,137 and was adjusted to

opening accumulated equity (deficit) at April 30, 2000.

Use of Estimates:

The preparation of financial statements, in conformity with accounting principles generally

accepted in the United States of America, requires management to make estimates and assumptions

that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and

liabilities at the date of the financial statements, and the reported amounts of revenues and expenses

F-7